Equity market

BSE-30 and Nifty-50 indices delivered a negative return for the month of February 2025 at -5.6% and -5.9% respectively. Mid-cap and Small Cap indices underperformed the benchmark indices with a loss of -10.5% and -13.8% respectively. On the sectoral front only the Banks and Metals sector outperformed the benchmark index, and the correction was very broad based from a sectoral perspective.February 2025 was another month of trending correction through the month specially for the mid cap and the small cap segment of the market led by large FII selling at -US$4bn.

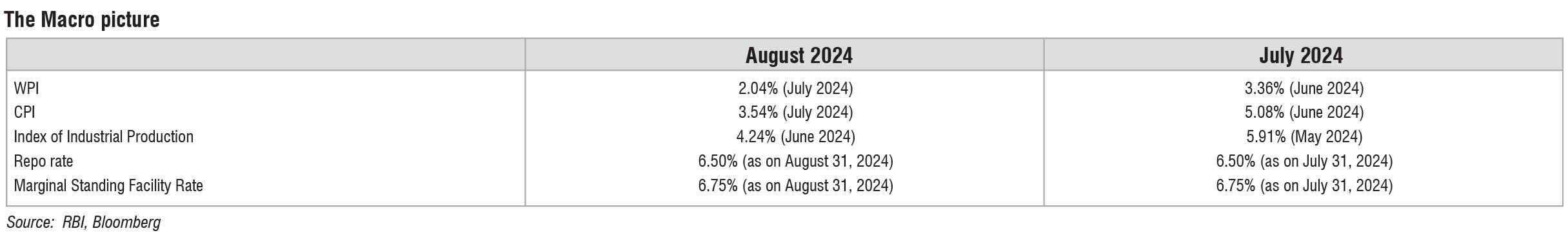

Inflation: India’s Wholesale Price Inflation (WPI) Index came in at 2.31% YoY during the current month as compared to 2.37% for the previous month on account of stable fuel, higher food and lower commodity prices.

CPI for January came in at 4.31%, lower than the Reuter’s poll (4.6%). Inflation moderated significantly as food inflation came in at a steady 6.02%. Within the food basket, Vegetable inflation moderated at 11.35%. Fruits, on the other hand, saw higher inflation of 12.22%. Pulses and products, a crucial component which had witnessed elevated inflation rates over the last two years, was at a comfortable 2.59%, thanks to 1) reduced import restrictions, 2) government purchases and 3) expectations of a strong winter crop. Oils and fats continued to see a spike off last year’s low base to 15.60%. The spike in vegetables and fruits has been an ongoing concern and needs to be closely watched. Outside of the food basket, personal care and products (10.58%) continued to see high inflation.

India's GDP growth picked up pace in Q3FY25 to 6.2% with primary driver of growth being Agriculture and Services from the supply side and Private and Government consumption from the expenditure side. Growth for the previous 2 years was revised sharply higher to 9.2% for FY24 (from 8.2%) and 7.6% for FY23 (from 7.0% earlier). Advance estimate for growth for FY25 was revised upwards marginally to 6.5% from 6.4% earlier. This implies growth of 7.6% in Q4. Q4 growth will be supported by revival in consumption demand (especially Rural), boost from Maha Kumbh and pick up in Government expenditure.

Other macro developments (fiscal deficit and household savings)

India’s Q2FY25 current account balance registered a deficit of US$11.4bn (1.2% of GDP) compared to a deficit of US$ 9.7bn (1.1% of GDP) for Q1FY25. The deficit represents higher gold imports which are likely to normalise going ahead.

India’s fiscal deficit came much lower than forecasted at 5.6% for FY24 on account of lower revenue expenditure. The government has announced a path to reduce fiscal deficit to 4.9% for FY25 (revised lower from 5.1% earlier) and below 4.5% in FY26.

FY24 net household financial savings rate stood at 5.3% of GDP (5.1% for FY23). The same ratio had moved higher during the pandemic period to 12% in FY21 compared to 7.7% in FY20.

Market Outlook:

CY2024 for India has been a more stable year in terms of GDP growth. 2024, as we have been highlighting in our past notes, is a year of general elections and it does lead to some lag in government decision making and spending. May 2024 is when the Modi government received its third mandate for the next 5 years. However, from an economic impact perspective decision making along with the release of required capital in spending came to a halt a few months prior to May 2024 and remained so right up to August-September 2024. In the process GDP growth came at the lower end of range around 6% for this period. For example, government capital expenditure for April 2024 to November 2024 was down 12% whereas as of January the same number is up 5% for FYTD2025. The months of December and January have seen a very sharp growth at 95% and 51% respectively. We expect high growth to sustain for the remaining 2 months of the year leading to double digit growth in annual capex for the full year.

Another casualty for the period was new ordering activity and payment of dues to vendors. Our recent on-ground research suggests to us that both these aspects are fully back on track, and one should expect higher growth in the economy for FY26 on the low base of FY25.

We in our portfolios are focused on companies which can grow earnings at a fast pace and most importantly balance sheets/cash flow being on the positive side with less leverage.

Long-term structural drivers like demographic advantage, low household debt, limited penetration across different consumer categories, increased potential for financial savings and urbanization makes India a compelling equity story from medium to long term perspective.

We believe investors would be well advised to invest with medium to long term perspective and systematically increase exposure to Indian equity markets.

Key portfolio actions – During the month we have booked profits from Redington India from the portfolio.

Disclaimer: The views expressed are in no way trying to predict the markets or to time them. The views expressed are for information purpose only and do not construe to be any investment, legal or taxation advice.

Please consult your Financial/Investment Adviser before investing. The views expressed may not reflect in the scheme portfolios of Tata Mutual Fund. This note has been prepared using information believed to be

accurate at the time of its use.