1) Scheme returns in terms of CAGR are provided for past 1 year, 3 years, 5 years and since inception.

2) Point-to-point returns on a standard investment of Rs. 10,000/- are in addition to CAGR for the schemes.

3) Different plans shall have a different expense structure. The performance details provided herein are of regular plan growth option except for Tata ELSS Tax Saver Fund , TATA Mid Cap Growth Fund & TATA Equity Savings Fund where performance details given is for regular plan IDCW option.

4) NA stands for schemes in existence for more than 1 year but less than 3 years or 5 years, or instances where benchmark data for corresponding period not available.

5) Period for which schemes performance has been provided is computed basis last day of the month - ended preceding the date of advertisement.

6) Past performance may or may not be sustained in future. For computation of since inception returns the allotment NAV has been taken as Rs. 10.00 (Except for Tata Liquid Fund, Tata Treasury Advantage Fund, Tata Corporate Bond Fund & Tata Money Market Fund where NAV is taken as Rs. 1,000). *All payouts during the period have been reinvested in the units of the scheme at the then prevailing NAV. Load is not considered for computation of returns. While calculating returns IDCW distribution tax is excluded. Schemes in existence for less than 1 year, performance details for the same are not provided.

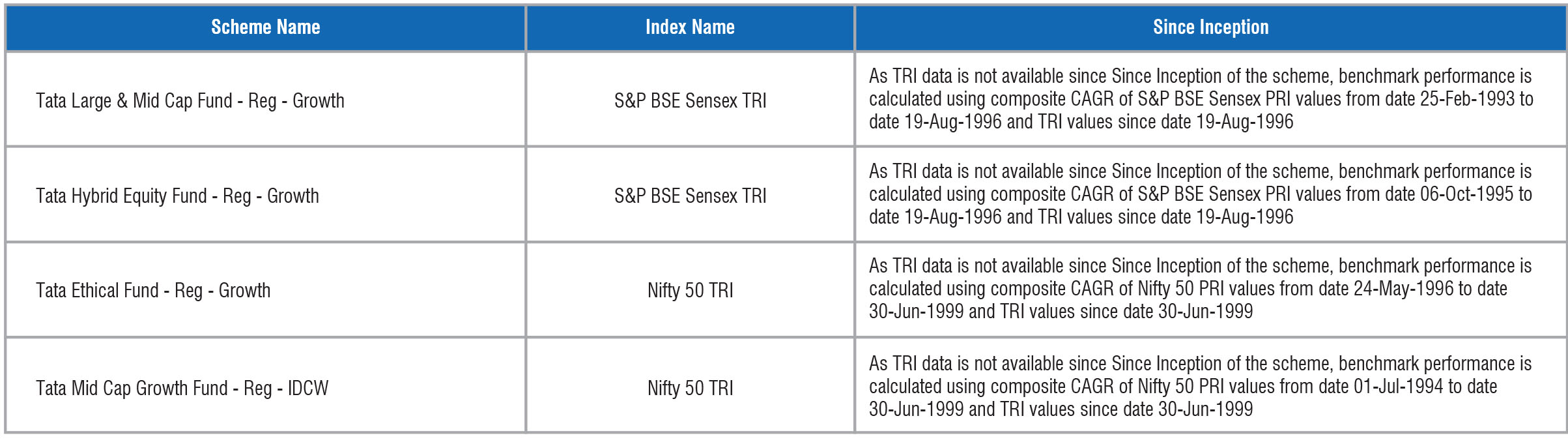

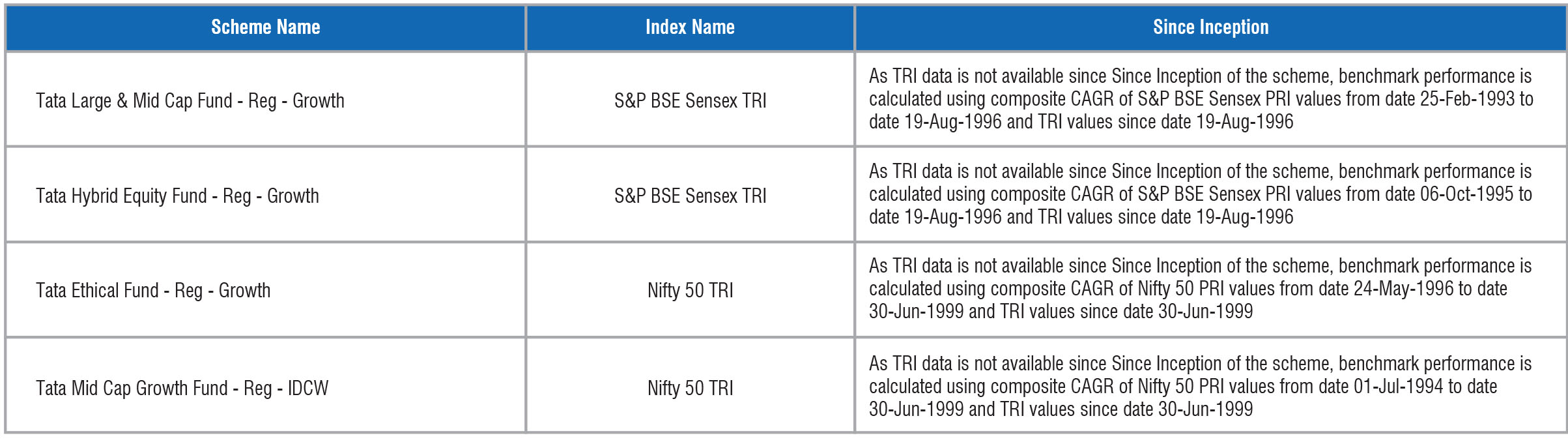

7) For Benchmark Indices Calculations , Total Return Index(TRI) has been used. Where ever TRI not available Composite CAGR has been disclosed .Please refer Disclaimer sheet for composite CAGR disclosure

8) ##The Scheme Returns are inclusive of the impact of Segregation of portfolio in the respective schemes.

9) Scheme in existence for more than six months but less than one year, simple annualized growth rate of the scheme for the past 6 months from the last day of month-end is provided.

10) In case of Overnight funds, Liquid funds and Money Market funds, the performance by way of simple annualisation of yields for 7 days, 15 days and 30 days is included.

11) a) Offshore Funds performance may differ from performance of other domestic funds managed by the Fund Manager. The Offshore Fund strategies are independent of the Domestic Funds managed by the same Fund Manager

b) The difference in returns of domestic Funds and the Offshore Funds can be attributed to several factors including impact of Currency exchange rate fluctuations, Fund flows and timing of portfolio investments. Foreign Portfolio Investment Schemes are also subject to Company and Sector level limits imposed by RBI & SEBI which can be different from domestic funds leading to difference in portfolio of similar strategy in domestic fund and FPI Funds.

12) Please refer the Addendums which are available on our web site for changes in Schemes Benchmarks which are effective 1st December 2021

NA - data are not available for the period

• After payment of IDCW the NAV will fall to the extent of IDCW payout and statutory levy, if any. (Unit face value - ₹ 10/-).

• Pursuant to allotment of bonus units, the NAV of the scheme would fall in proportion to the bonus units allotted & as a result the total value of units held by investor would remain the same.

$-ICRA’s mutual fund rating methodology is based on evaluating the inherent credit quality of the fund’s portfolio. As a measure of the credit quality of a debt fund’s assets. ICRA uses the concept of ‘credit scores’. These scores are based on ICRA’s estimates of credit risk associated with each exposure of the portfolio taking into account its maturity. To quantify the credit risk scores, ICRA uses its database of historical default rates for various rating categories for various maturity buckets. The credit risk ratings incorporate ICRA’s assessment of a debt fund’s published investment objectives and policies, its management characteristics, and the creditworthness of its investment portfolio. ICRA reviews relevant fund information on an ongoing basis to support its published rating opinions. If the portfolio credit score meets the benchmark of the assigned rating during the review, the rating is retained. In an event that the benchmark credit score is breached, ICRA gives a month’s time to the debt fund manager to bring the portfolio credit score within the benchmark credit score. If the debt fund manager is able to reduce the portfolio credit score within the benchmark credit score, the rating is retained. If the portfolio still continues to breach the benchmark credit score, the rating is revised to reflect the change in credit quality.

2) Point-to-point returns on a standard investment of Rs. 10,000/- are in addition to CAGR for the schemes.

3) Different plans shall have a different expense structure. The performance details provided herein are of regular plan growth option except for Tata ELSS Tax Saver Fund , TATA Mid Cap Growth Fund & TATA Equity Savings Fund where performance details given is for regular plan IDCW option.

4) NA stands for schemes in existence for more than 1 year but less than 3 years or 5 years, or instances where benchmark data for corresponding period not available.

5) Period for which schemes performance has been provided is computed basis last day of the month - ended preceding the date of advertisement.

6) Past performance may or may not be sustained in future. For computation of since inception returns the allotment NAV has been taken as Rs. 10.00 (Except for Tata Liquid Fund, Tata Treasury Advantage Fund, Tata Corporate Bond Fund & Tata Money Market Fund where NAV is taken as Rs. 1,000). *All payouts during the period have been reinvested in the units of the scheme at the then prevailing NAV. Load is not considered for computation of returns. While calculating returns IDCW distribution tax is excluded. Schemes in existence for less than 1 year, performance details for the same are not provided.

7) For Benchmark Indices Calculations , Total Return Index(TRI) has been used. Where ever TRI not available Composite CAGR has been disclosed .Please refer Disclaimer sheet for composite CAGR disclosure

8) ##The Scheme Returns are inclusive of the impact of Segregation of portfolio in the respective schemes.

9) Scheme in existence for more than six months but less than one year, simple annualized growth rate of the scheme for the past 6 months from the last day of month-end is provided.

10) In case of Overnight funds, Liquid funds and Money Market funds, the performance by way of simple annualisation of yields for 7 days, 15 days and 30 days is included.

11) a) Offshore Funds performance may differ from performance of other domestic funds managed by the Fund Manager. The Offshore Fund strategies are independent of the Domestic Funds managed by the same Fund Manager

b) The difference in returns of domestic Funds and the Offshore Funds can be attributed to several factors including impact of Currency exchange rate fluctuations, Fund flows and timing of portfolio investments. Foreign Portfolio Investment Schemes are also subject to Company and Sector level limits imposed by RBI & SEBI which can be different from domestic funds leading to difference in portfolio of similar strategy in domestic fund and FPI Funds.

12) Please refer the Addendums which are available on our web site for changes in Schemes Benchmarks which are effective 1st December 2021

NA - data are not available for the period

• After payment of IDCW the NAV will fall to the extent of IDCW payout and statutory levy, if any. (Unit face value - ₹ 10/-).

• Pursuant to allotment of bonus units, the NAV of the scheme would fall in proportion to the bonus units allotted & as a result the total value of units held by investor would remain the same.

• The Std. Dev., Sharpe Ratio, Jensen’s Alpha, Treynor, Portfolio Beta & R-squared are based on one month return calculated using last 3 years data.

• Price/Earning Ratio, Price/Book Value Ratio, are based on the historical earnings and accounting numbers, and have been computed only for the invested portion of the portfolio.

• Portfolio turnover has been computed as the ratio of the lower value of average purchase and average sales to the average net assets in the past one year (For schemes that have not completed one year, since inception is considered)

• Cash & Cash Equivalents includes CBLO, REPO, Fixed Deposits and Cash & Bank Balance.

• Price/Earning Ratio, Price/Book Value Ratio, are based on the historical earnings and accounting numbers, and have been computed only for the invested portion of the portfolio.

• Portfolio turnover has been computed as the ratio of the lower value of average purchase and average sales to the average net assets in the past one year (For schemes that have not completed one year, since inception is considered)

• Cash & Cash Equivalents includes CBLO, REPO, Fixed Deposits and Cash & Bank Balance.

$-ICRA’s mutual fund rating methodology is based on evaluating the inherent credit quality of the fund’s portfolio. As a measure of the credit quality of a debt fund’s assets. ICRA uses the concept of ‘credit scores’. These scores are based on ICRA’s estimates of credit risk associated with each exposure of the portfolio taking into account its maturity. To quantify the credit risk scores, ICRA uses its database of historical default rates for various rating categories for various maturity buckets. The credit risk ratings incorporate ICRA’s assessment of a debt fund’s published investment objectives and policies, its management characteristics, and the creditworthness of its investment portfolio. ICRA reviews relevant fund information on an ongoing basis to support its published rating opinions. If the portfolio credit score meets the benchmark of the assigned rating during the review, the rating is retained. In an event that the benchmark credit score is breached, ICRA gives a month’s time to the debt fund manager to bring the portfolio credit score within the benchmark credit score. If the debt fund manager is able to reduce the portfolio credit score within the benchmark credit score, the rating is retained. If the portfolio still continues to breach the benchmark credit score, the rating is revised to reflect the change in credit quality.