| Tata Banking & Financial Services Fund

(An open ended equity scheme investing in Banking & Financial Services Sector) |

|

As on 28th February 2025

|

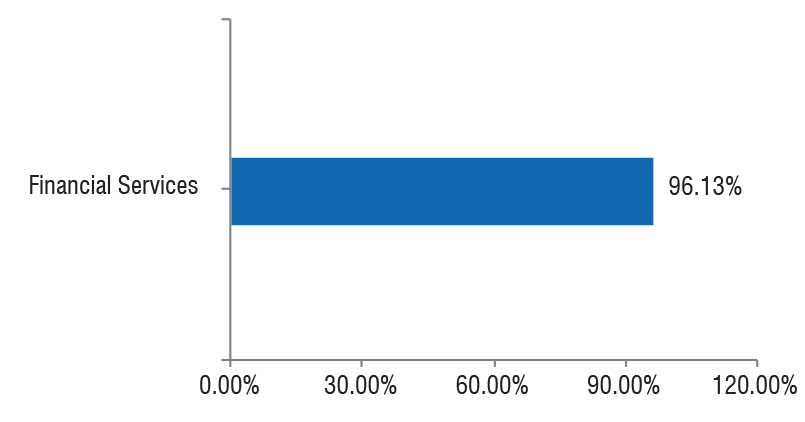

Primarily focuses on investment in at least 80% of its net assets in equity/equity related instruments of the companies in the Banking and Financial Services sector in India.

INVESTMENT OBJECTIVE:The investment objective of the scheme is to seek long term capital appreciation by investing atleast 80% of its net assets in equity/equity related instruments of the companies in the Banking and Financial Services sector in India.

DATE OF ALLOTMENT:December 28,2015

FUND MANAGER(S)Amey Sathe (Managing Since 14-Oct-2021 and overall experience of 17 years) (Managed in the past from 18-Jun-2018 till 13-Oct-2021 as Assistant Fund Manager)

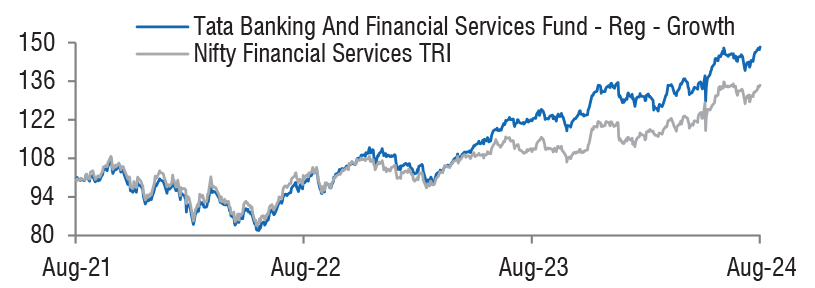

BENCHMARK:Nifty Financial Services TRI

NAV (in Rs.)| Direct - IDCW | : 42.5041 |

| Direct - Growth | : 42.5041 |

| Reg - IDCW | : 33.7514 |

| Reg - Growth | : 36.6960 |

| FUND SIZE | |

| Rs. 2284.89 (Rs. in Cr.) | |

| MONTHLY AVERAGE AUM | |

| Rs. 2312.95 (Rs. in Cr.) | |

| TURN OVER | |

| Portfolio Turnover (Equity component only) | 19.65% |

| EXPENSE RATIO** | |

| Direct | 0.57 |

| Regular | 2.00 |

| **Note: The rates specified are actual month end expenses charged as on Feb 28, 2025. The above ratio includes the Service tax on Investment Management Fees. The above ratio excludes, borrowing cost, wherever applicable. | |

| VOLATILITY MEASURES^ | FUND | BENCHMARK |

| Std. Dev (Annualised) | 14.18 | 14.03 |

| Sharpe Ratio | 0.62 | 0.41 |

| Portfolio Beta | 0.91 | NA |

| R Squared | 0.86 | NA |

| Treynor | 0.81 | NA |

| Jenson | 0.29 | NA |

| ^Risk-free rate based on the FBIL Overnight MIBOR rate of 6.4% as

on Feb 28, 2025 For calculation methodology | ||

MULTIPLES FOR NEW INVESTMENT:

Rs. 5,000/- and in multiples of Re. 1/- thereafter.

ADDITIONAL INVESTMENT/MULTIPLES FOR EXISTING INVESTORS:

Rs. 1,000/- and multiples of Re. 1/- thereafter.

LOAD STRUCTURE:| ENTRY LOAD | Not Applicable |

| EXIT LOAD | 0.25% of NAV if redeemed/switched out

before 30 days from the date of allotment. |

Please refer to our Tata Mutual Fund website for fundamental changes, wherever applicable

| Company name | No. of Shares | Market Value Rs Lakhs | % of Assets |

| Equity & Equity Related Total | 225486.37 | 98.67 | |

| Banks | |||

| HDFC Bank Ltd. | 3200000 | 55436.80 | 24.26 |

| Kotak Mahindra Bank Ltd. | 1150000 | 21883.93 | 9.58 |

| Axis Bank Ltd. | 2000000 | 20311.00 | 8.89 |

| ICICI Bank Ltd. | 1665000 | 20048.27 | 8.77 |

| State Bank Of India | 990000 | 6819.12 | 2.98 |

| Bandhan Bank Ltd. | 3000000 | 4235.70 | 1.85 |

| Indusind Bank Ltd. | 420000 | 4158.42 | 1.82 |

| Au Small Finance Bank Ltd. | 600000 | 3394.20 | 1.49 |

| Dcb Bank Ltd. | 2880022 | 3002.42 | 1.31 |

| Rbl Bank Ltd. | 1700000 | 2691.78 | 1.18 |

| IDFC First Bank Ltd. | 4300000 | 2510.77 | 1.10 |

| Karur Vysya Bank Ltd. | 900000 | 1809.99 | 0.79 |

| Fino Payments Bank Ltd. | 693000 | 1537.42 | 0.67 |

| Equitas Small Finance Bank Ltd. | 700000 | 398.09 | 0.17 |

| Capital Markets | |||

| Uti Asset Management Company Ltd. | 350000 | 3293.15 | 1.44 |

| Prudent Corporate Advisory Services Ltd. | 150000 | 2481.98 | 1.09 |

| Multi Commodity Exchange Of Ind Ltd. | 25000 | 1247.91 | 0.55 |

| Finance | |||

| Sbi Cards And Payment Services Ltd. | 880000 | 7381.44 | 3.23 |

| Bajaj Finance Ltd. | 70000 | 5971.21 | 2.61 |

| Pnb Housing Finance Ltd. | 750000 | 5725.13 | 2.51 |

| India Shelter Finance Corporation Ltd. | 650000 | 4725.50 | 2.07 |

| Home First Finance Company India Ltd. | 450000 | 4583.93 | 2.01 |

| Sbfc Finance Ltd. | 4800000 | 4236.96 | 1.85 |

| Five-Star Business Finance Ltd. | 547551 | 4169.60 | 1.82 |

| Aavas Financiers Ltd. | 244620 | 4123.19 | 1.80 |

| Aptus Value Housing Finance India Ltd. | 1200000 | 3690.60 | 1.62 |

| Repco Home Finance Ltd. | 750000 | 2478.75 | 1.08 |

| L&T Finance Ltd. | 1500000 | 2020.95 | 0.88 |

| Rec Ltd. | 400000 | 1441.20 | 0.63 |

| Financial Technology (Fintech) | |||

| One 97 Communications Ltd. | 550000 | 3932.23 | 1.72 |

| Pb Fintech Ltd. | 40000 | 585.44 | 0.26 |

| Insurance | |||

| ICICI Lombard General Insurance Co. Ltd. | 325000 | 5495.59 | 2.41 |

| HDFC Life Insurance Co. Ltd. | 850000 | 5172.25 | 2.26 |

| Max Financial Services Ltd. | 450000 | 4491.45 | 1.97 |

| Repo | 2156.86 | 0.94 | |

| Portfolio Total | 227643.23 | 99.61 | |

| Cash / Net Current Asset | 845.62 | 0.39 | |

| Net Assets | 228488.85 | 100.00 | |

| Issuer Name | % to NAV |

| HDFC Bank Ltd. | 24.26 |

| Kotak Mahindra Bank | 9.58 |

| Axis Bank Ltd. | 8.89 |

| ICICI Bank Ltd. | 8.77 |

| Sbi Cards & Payment Services Ltd. | 3.23 |

| State Bank Of India | 2.98 |

| Bajaj Finance Ltd. | 2.61 |

| Pnb Housing Finance Ltd. | 2.51 |

| ICICI Lombard General Insurance Co. Ltd. | 2.41 |

| HDFC Life Insurance Co. Ltd. | 2.26 |

| Total | 67.50 |

| Large Cap | 60.79% |

| Mid Cap | 15.07% |

| Small Cap | 24.14% |

| Market Capitalisation is as per list provided by AMFI. | |