| Tata Housing Opportunities Fund

(An open-ended equity scheme following housing theme.) |

|

As on 28th February 2025

|

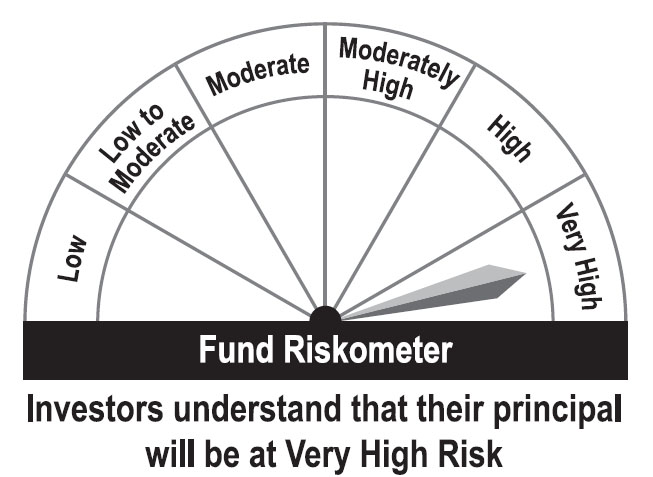

To follow investment strategy with focus on investment in Equity and equity related instruments of entities engaged in activities of Housing theme.

INVESTMENT OBJECTIVE:To generate long-term capital appreciation by investing predominantly in equity and equity related instruments of entities engaged in and/or expected to benefit from the growth in housing theme. However, there is no assurance or guarantee that the investment objective of the Scheme will be achieved. The scheme does not assure or guarantee any returns.

DATE OF ALLOTMENT:September 02,2022

FUND MANAGER(S)Tejas Gutka (Equity Portfolio) (Managing Since 02-Sep-2022 and overall experience of 18 years),Murthy Nagarajan (Debt Portfolio) (Managing Since 02-Sep-2022 and overall experience of 28 years),Kapil Malhotra (Overseas Portfolio) (Managing Since 19-Dec-23 and overall experience of 15 years)

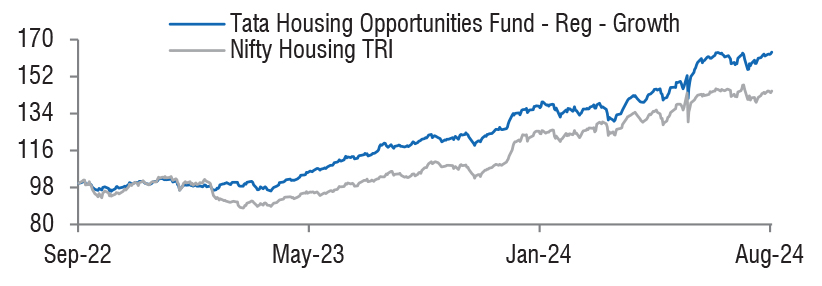

BENCHMARK:NIFTY Housing Index TRI

NAV (in Rs.)| Direct - Growth | : 13.4350 |

| Direct - IDCW | : 13.4350 |

| Reg - Growth | : 12.8620 |

| Reg - IDCW | : 12.8620 |

| FUND SIZE | |

| Rs. 475.79 (Rs. in Cr.) | |

| MONTHLY AVERAGE AUM | |

| Rs. 507.53 (Rs. in Cr.) | |

| TURN OVER | |

| Portfolio Turnover (Equity component only) | 6.62% |

| EXPENSE RATIO** | |

| Direct | 0.76 |

| Regular | 2.41 |

| **Note: The rates specified are actual month end expenses charged

as on Feb 28, 2025. The above ratio includes the GST on Investment

Management Fees. The above ratio excludes, borrowing cost,

wherever applicable. ^Risk-free rate based on the FBIL Overnight MIBOR rate of 6.4% as on Feb 28, 2025 For calculation methodology | |

MULTIPLES FOR NEW INVESTMENT:

Rs.5,000/- and in multiple of Re.1/- thereafter

ADDITIONAL INVESTMENT/MULTIPLES FOR EXISTING INVESTORS:

Rs.1,000/- and in multiples of Re.1/-thereafter

LOAD STRUCTURE:| ENTRY LOAD | Not Applicable |

| EXIT LOAD | Redemption / Switch-out / SWP / STP on

or before expiry of 30 days from the date

of allotment: 1% |

Please refer to our Tata Mutual Fund website for fundamental changes, wherever applicable

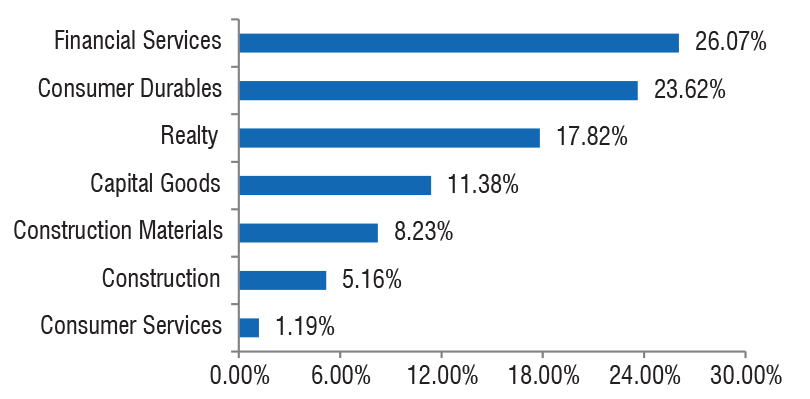

| Company name | No. of Shares | Market Value Rs Lakhs | % of Assets |

| Equity & Equity Related Total | 44990.47 | 94.54 | |

| Banks | |||

| HDFC Bank Ltd. | 268600 | 4653.23 | 9.78 |

| ICICI Bank Ltd. | 185000 | 2227.59 | 4.68 |

| State Bank Of India | 190000 | 1308.72 | 2.75 |

| Kotak Mahindra Bank Ltd. | 55000 | 1046.62 | 2.20 |

| Cement & Cement Products | |||

| Ambuja Cements Ltd. | 406600 | 1890.49 | 3.97 |

| Ultratech Cement Ltd. | 18500 | 1873.76 | 3.94 |

| The Ramco Cements Ltd. | 80000 | 663.20 | 1.39 |

| Construction | |||

| Larsen & Toubro Ltd. | 84500 | 2673.45 | 5.62 |

| Consumer Durables | |||

| Blue Star Ltd. | 104000 | 1994.36 | 4.19 |

| Voltas Ltd. | 132000 | 1742.53 | 3.66 |

| Havells India Ltd. | 95000 | 1350.71 | 2.84 |

| Asian Paints (India) Ltd. | 58800 | 1281.69 | 2.69 |

| Kajaria Ceramics Ltd. | 125000 | 1065.38 | 2.24 |

| Cera Sanitaryware Ltd. | 19804 | 1047.88 | 2.20 |

| Greenpanel Industries Ltd. | 373990 | 1005.85 | 2.11 |

| Greenply Industries Ltd. | 336169 | 916.40 | 1.93 |

| Orient Electric Ltd. | 298588 | 591.83 | 1.24 |

| Finance | |||

| Can Fin Homes Ltd. | 342000 | 1975.56 | 4.15 |

| Pnb Housing Finance Ltd. | 180000 | 1374.03 | 2.89 |

| Bajaj Finance Ltd. | 15000 | 1279.55 | 2.69 |

| India Shelter Finance Corporation Ltd. | 151267 | 1099.71 | 2.31 |

| Industrial Products | |||

| Kei Industries Ltd. | 52000 | 1596.48 | 3.36 |

| Supreme Industries Ltd. | 37000 | 1231.73 | 2.59 |

| R R Kabel Ltd. | 82592 | 735.28 | 1.55 |

| Astral Ltd. (Erstwhile Astral Poly Technik Ltd.) | 52000 | 695.37 | 1.46 |

| Realty | |||

| Prestige Estates Projects Ltd. | 218000 | 2455.99 | 5.16 |

| Dlf Ltd. | 305000 | 1938.43 | 4.07 |

| Brigade Enterprises Ltd. | 170000 | 1609.99 | 3.38 |

| Tarc Ltd. | 700000 | 834.05 | 1.75 |

| Suraj Estate Developers Ltd. | 135000 | 403.25 | 0.85 |

| Retailing | |||

| Electronics Mart India Ltd. | 339090 | 427.36 | 0.90 |

| Repo | 1515.95 | 3.19 | |

| Portfolio Total | 46506.42 | 97.73 | |

| Cash / Net Current Asset | 1073.00 | 2.27 | |

| Net Assets | 47579.42 | 100.00 | |

| Issuer Name | % to NAV |

| HDFC Bank Ltd. | 9.78 |

| Larsen & Toubro Ltd. | 5.62 |

| Prestige Estates Projects Ltd. | 5.16 |

| ICICI Bank Ltd. | 4.68 |

| Blue Star Ltd. | 4.19 |

| Can Fin Homes Ltd. | 4.15 |

| Dlf Ltd. | 4.07 |

| Ambuja Cements Ltd. | 3.97 |

| Ultratech Cement Ltd. | 3.94 |

| Voltas Ltd. | 3.66 |

| Total | 49.22 |

| Large Cap | 47.84% |

| Mid Cap | 21.60% |

| Small Cap | 30.56% |

| Market Capitalisation is as per list provided by AMFI. | |