| Tata India Innovation Fund

(An open-ended equity scheme following innovation theme) |

|

As on 28th February 2025

|

An open-ended equity scheme following innovation theme

INVESTMENT OBJECTIVE:The investment objective of the scheme is to provide investors with opportunities for long term capital appreciation by investing in equity and equity related instruments of companies that seeks to benefit from adoption of innovative strategies & theme. However, there is no assurance or guarantee that the investment objective of the scheme will be achieved. The scheme does not assure or guarantee any returns.

DATE OF ALLOTMENT:November 28,2024

FUND MANAGER(S)Meeta Shetty (Managing Since 28-Nov-24 and overall experience of 18 years), Kapil Malhotra (Managing Since 28-Nov-24 and overall experience of 15 years)

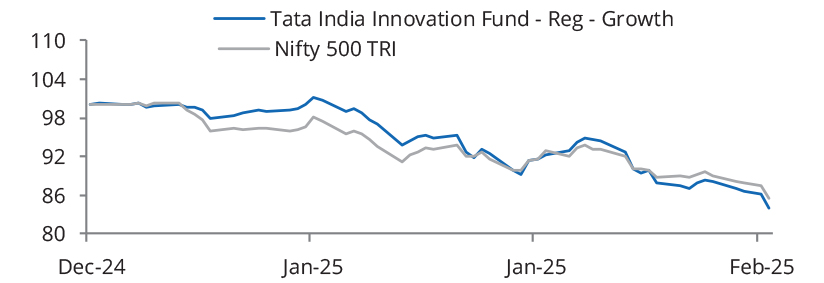

BENCHMARK:Nifty 500 TRI

NAV (in Rs.)| Direct - Growth | : 8.5479 |

| Direct - IDCW | : 8.5479 |

| Reg - Growth | : 8.5144 |

| Reg - IDCW | : 8.5144 |

| FUND SIZE | |

| Rs. 1547.74 (Rs. in Cr.) | |

| MONTHLY AVERAGE AUM | |

| Rs.1644.24(Rs. in Cr.) | |

| TURN OVER | |

| Portfolio Turnover (Equity component only) | 0.75% |

| EXPENSE RATIO** | |

| Direct | 0.51 |

| Regular | 2.06 |

| **Note: The rates specified are actual month end expenses charged

as on Feb 28, 2025. The above ratio includes the GST on Investment

Management Fees. The above ratio excludes, borrowing cost,

wherever applicable. ^Risk-free rate based on the FBIL Overnight MIBOR rate of 6.4% as on Feb 28, 2025 For calculation methodology | |

MULTIPLES FOR NEW INVESTMENT:

Rs.5,000/- and in multiple of Re.1/- thereafter

ADDITIONAL INVESTMENT/MULTIPLES FOR EXISTING INVESTORS:

Rs.1,000/- and in multiples of Re.1/-thereafter

LOAD STRUCTURE:| ENTRY LOAD | Not Applicable |

| EXIT LOAD | 1% of the applicable NAV, if redeemed on

or before 90 days from the date of

allotment. |

Please refer to our Tata Mutual Fund website for fundamental changes, wherever applicable

| Company name | No. of Shares | Market Value Rs Lakhs | % of Assets |

| Equity & Equity Related Total | 142581.59 | 92.11 | |

| Aerospace And Defense | |||

| Unimech Aerospace & Manufacturing Ltd. | 134827 | 1232.39 | 0.80 |

| Auto Components | |||

| Zf Commercial Vehicle Control Systems India Ltd. | 15500 | 1695.99 | 1.10 |

| Craftsman Automation Ltd. | 35000 | 1575.65 | 1.02 |

| Samvardhana Motherson International Ltd. | 1275000 | 1512.02 | 0.98 |

| Pricol Ltd. | 269429 | 1071.92 | 0.69 |

| Automobiles | |||

| Hero Motocorp Ltd. | 100000 | 3681.10 | 2.38 |

| Banks | |||

| Axis Bank Ltd. | 546000 | 5544.90 | 3.58 |

| ICICI Bank Ltd. | 418000 | 5033.14 | 3.25 |

| HDFC Bank Ltd. | 263000 | 4556.21 | 2.94 |

| Indusind Bank Ltd. | 350000 | 3465.35 | 2.24 |

| Capital Markets | |||

| Kfin Technologies Ltd. | 236414 | 2058.34 | 1.33 |

| Chemicals & Petrochemicals | |||

| Neogen Chemicals Ltd. | 93619 | 1562.59 | 1.01 |

| Pcbl Ltd. | 425000 | 1521.50 | 0.98 |

| Commercial Services & Supplies | |||

| Firstsource Solutions Ltd. | 1318395 | 4561.65 | 2.95 |

| Eclerx Services Ltd. | 77321 | 2191.20 | 1.42 |

| Construction | |||

| Larsen & Toubro Ltd. | 101500 | 3211.31 | 2.07 |

| Consumer Durables | |||

| Amber Enterprises India Ltd. | 112600 | 6337.86 | 4.09 |

| Kajaria Ceramics Ltd. | 382043 | 3256.15 | 2.10 |

| Electrical Equipment | |||

| Thermax Ltd. | 52521 | 1706.14 | 1.10 |

| Finance | |||

| Bajaj Finance Ltd. | 50000 | 4265.15 | 2.76 |

| Sbi Cards And Payment Services Ltd. | 425616 | 3570.07 | 2.31 |

| Financial Technology (Fintech) | |||

| Pb Fintech Ltd. | 354630 | 5190.36 | 3.35 |

| Healthcare Equipment & Supplies | |||

| Laxmi Dental Ltd. | 50251 | 170.48 | 0.11 |

| Healthcare Services | |||

| Dr. Lal Path Labs Ltd. | 120000 | 2772.54 | 1.79 |

| Syngene International Ltd. | 227220 | 1482.38 | 0.96 |

| It - Services | |||

| Affle (India) Ltd. | 203977 | 2856.19 | 1.85 |

| It - Software | |||

| Tech Mahindra Ltd. | 397000 | 5906.76 | 3.82 |

| Tata Consultancy Services Ltd. | 155000 | 5399.04 | 3.49 |

| Newgen Software Technologies Ltd. | 247732 | 2319.39 | 1.50 |

| Sonata Software Ltd. | 575821 | 2078.71 | 1.34 |

| Zensar Technologies Ltd. | 273335 | 2018.44 | 1.30 |

| Infosys Ltd. | 50000 | 843.85 | 0.55 |

| Quick Heal Technologies Ltd. | 187403 | 554.99 | 0.36 |

| Industrial Products | |||

| Carborundum Universal Ltd. | 115433 | 960.00 | 0.62 |

| Leisure Services | |||

| Jubilant Foodworks Ltd. | 502254 | 3144.61 | 2.03 |

| Westlife Foodworld Ltd. | 316842 | 2164.19 | 1.40 |

| Petroleum Products | |||

| Reliance Industries Ltd. | 267000 | 3204.27 | 2.07 |

| Pharmaceuticals & Biotechnology | |||

| Suven Pharmaceuticals Ltd. | 225000 | 2733.08 | 1.77 |

| Laurus Labs Ltd. | 510881 | 2693.36 | 1.74 |

| Ami Organics Ltd. | 97500 | 2114.43 | 1.37 |

| Aurobindo Pharma Ltd. | 160000 | 1693.28 | 1.09 |

| Dr Reddys Laboratories Ltd. | 150000 | 1674.75 | 1.08 |

| Orchid Pharma Ltd. | 144093 | 1384.81 | 0.89 |

| Indoco Remedies Ltd. | 553506 | 1087.47 | 0.70 |

| Piramal Pharma Ltd. | 400000 | 759.56 | 0.49 |

| Wockhardt Ltd. | 59354 | 685.84 | 0.44 |

| Retailing | |||

| Zomato Ltd. | 2789600 | 6195.70 | 4.00 |

| Info Edge (India) Ltd. | 49109 | 3434.02 | 2.22 |

| Medplus Health Services Ltd. | 334864 | 2392.94 | 1.55 |

| Cartrade Tech Ltd. | 60192 | 920.06 | 0.59 |

| Telecom - Services | |||

| Bharti Airtel Ltd. | 314548 | 4939.03 | 3.19 |

| Tata Communications Ltd. | 199477 | 2697.93 | 1.74 |

| Transport Services | |||

| Delhivery Ltd. | 1000000 | 2498.50 | 1.61 |

| Repo | 2890.34 | 1.87 | |

| Portfolio Total | 145471.93 | 93.98 | |

| Cash / Net Current Asset | 9302.50 | 6.02 | |

| Net Assets | 154774.43 | 100.00 | |

| Issuer Name | % to NAV |

| Amber Enterprises India Ltd. | 4.09 |

| Zomato Ltd. | 4.00 |

| Tech Mahindra Ltd. | 3.82 |

| Axis Bank Ltd. | 3.58 |

| Tata Consultancy Services Ltd. | 3.49 |

| Pb Fintech Ltd. | 3.35 |

| ICICI Bank Ltd. | 3.25 |

| Bharti Airtel Ltd. | 3.19 |

| Firstsource Solutions Ltd. | 2.95 |

| HDFC Bank Ltd. | 2.94 |

| Total | 34.66 |

| Large Cap | 41.66% |

| Mid Cap | 16.10% |

| Small Cap | 42.24% |

| Market Capitalisation is as per list provided by AMFI. | |