| Tata Large & Mid Cap Fund

(An open-ended equity scheme investing in both large cap & mid cap stocks.) |

|

As on 28th February 2025

|

Primarily focuses on investing in equity and equity related instruments of well researched value and growth oriented Large & Mid Cap Companies.

INVESTMENT OBJECTIVE:To provide income distribution and / or medium to long term capital gains while at all times emphasizing the importance of capital appreciation. However, there is no assurance or guarantee that the investment objective of the Scheme will be achieved. The scheme does not assure or guarantee any returns.

DATE OF ALLOTMENT:February 25,1993

FUND MANAGER(S)Chandraprakash Padiyar (Managing Since 03-Sep-18 and overall experience of 24 years)

ASSISTANT FUND MANAGER:Meeta Shetty (Managing Since 1-Nov-19 and overall experience of 18 years)

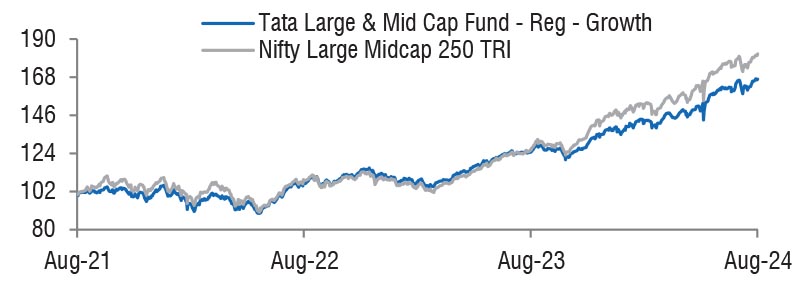

BENCHMARK:Nifty Large Midcap 250 TRI

NAV (in Rs.)| Direct - Growth | : 516.9850 |

| Direct - IDCW | : 101.2942 |

| Reg - Growth | : 455.4530 |

| Reg - IDCW | : 73.4154 |

| FUND SIZE | |

| Rs. 7419.57 (Rs. in Cr.) | |

| MONTHLY AVERAGE AUM | |

| Rs. 7750.21 (Rs. in Cr.) | |

| TURN OVER | |

| Portfolio Turnover (Equity component only) | 9.69% |

| EXPENSE RATIO** | |

| Direct | 0.67 |

| Regular | 1.79 |

| **Note: The rates specified are actual month end expenses charged as on Feb 28, 2025. The above ratio includes the GST on Investment Management Fees. The above ratio excludes, borrowing cost, wherever applicable. | |

| VOLATILITY MEASURES^ | FUND | BENCHMARK |

| Std. Dev (Annualised) | 12.98 | 14.99 |

| Sharpe Ratio | 0.58 | 0.60 |

| Portfolio Beta | 0.81 | NA |

| R Squared | 0.93 | NA |

| Treynor | 0.78 | NA |

| Jenson | 0.02 | NA |

| ^Risk-free rate based on the FBIL Overnight MIBOR rate of 6.4% as on Feb 28, 2025 For calculation methodology | ||

MULTIPLES FOR NEW INVESTMENT:

Rs. 5,000/- and in multiples of Re. 1/- thereafter.

ADDITIONAL INVESTMENT/MULTIPLES FOR EXISTING INVESTORS:

Rs. 1,000/- and multiples of Re. 1/- thereafter.

LOAD STRUCTURE:| ENTRY LOAD | Not Applicable |

| EXIT LOAD |

1) On or before expiry of 90 days from the date of

allotment: If the withdrawal amount or switched out

amount is not more than 12% of the original cost of

investment: NIL. 2) On or before expiry of 90 days from the date of allotment: If the withdrawal amount or switched out amount is more than 12% of the original cost of investment: 1%. 3) Redemption after expiry of 90 days from the date of allotment: NIL. (w.e.f 26 December, 2022) |

Please refer to our Tata Mutual Fund website for fundamental changes, wherever applicable

| Company Name | No. of Shares | Market Value Rs Lakhs | % of assets |

| Equity & Equity Related Total | 699163.88 | 94.24 | |

| Agricultural Food & Other Products | |||

| Patanjali Foods Ltd. | 296277 | 5216.10 | 0.70 |

| Auto Components | |||

| Sundram Fasteners Ltd. | 1456877 | 13605.77 | 1.83 |

| Bharat Forge Ltd. | 720646 | 7325.37 | 0.99 |

| Tube Investments Of India Ltd.. | 127832 | 3147.42 | 0.42 |

| Automobiles | |||

| Tata Motors Ltd. | 2100000 | 13033.65 | 1.76 |

| Banks | |||

| HDFC Bank Ltd. | 4466799 | 77382.83 | 10.43 |

| ICICI Bank Ltd. | 2550000 | 30704.55 | 4.14 |

| State Bank Of India | 4350000 | 29962.80 | 4.04 |

| IDFC First Bank Ltd. | 43500000 | 25399.65 | 3.42 |

| Bandhan Bank Ltd. | 8800000 | 12424.72 | 1.67 |

| Kotak Mahindra Bank Ltd. | 290000 | 5518.56 | 0.74 |

| Beverages | |||

| Varun Beverages Ltd. | 6786250 | 29591.44 | 3.99 |

| Capital Markets | |||

| HDFC Asset Management Company Ltd. | 525000 | 19048.58 | 2.57 |

| Cement & Cement Products | |||

| ACC Ltd. | 659217 | 11988.19 | 1.62 |

| The Ramco Cements Ltd. | 1100000 | 9119.00 | 1.23 |

| Ultratech Cement Ltd. | 56000 | 5671.93 | 0.76 |

| Chemicals & Petrochemicals | |||

| Basf India Ltd. | 263657 | 11301.26 | 1.52 |

| Elantas Beck India Ltd. | 94264 | 7924.44 | 1.07 |

| Commercial Services & Supplies | |||

| Quess Corp Ltd. | 2378531 | 14205.78 | 1.91 |

| Redington (India) Ltd. | 4475085 | 10038.51 | 1.35 |

| Construction | |||

| Larsen & Toubro Ltd. | 363164 | 11489.96 | 1.55 |

| Consumer Durables | |||

| Akzo Nobel India Ltd. | 181800 | 5654.43 | 0.76 |

| Diversified | |||

| Godrej Industries Ltd. | 1880566 | 20641.09 | 2.78 |

| Diversified Fmcg | |||

| ITC Ltd. | 2303000 | 9096.85 | 1.23 |

| Hindustan Unilever Ltd. | 115000 | 2518.79 | 0.34 |

| Electrical Equipment | |||

| Thermax Ltd. | 180000 | 5847.30 | 0.79 |

| Fertilizers & Agrochemicals | |||

| Pi Industries Ltd. | 1007556 | 30367.23 | 4.09 |

| Finance | |||

| Sbi Cards And Payment Services Ltd. | 3209286 | 26919.49 | 3.63 |

| Mahindra And Mahindra Financial Services Ltd. | 4600000 | 12447.60 | 1.68 |

| LIC Housing Finance Ltd. | 2200000 | 10931.80 | 1.47 |

| Gas | |||

| Gujarat State Petronet Ltd. | 1950000 | 5308.88 | 0.72 |

| Healthcare Services | |||

| Fortis Healthcare Ltd. | 3574802 | 21902.81 | 2.95 |

| It - Software | |||

| Tata Consultancy Services Ltd. | 314205 | 10944.55 | 1.48 |

| Infosys Ltd. | 500000 | 8438.50 | 1.14 |

| Oracle Financials Services Soft Ltd. | 50000 | 3881.95 | 0.52 |

| Industrial Products | |||

| Cummins India Ltd. | 630000 | 17123.09 | 2.31 |

| Aia Engineering Ltd. | 344618 | 10825.31 | 1.46 |

| Leisure Services | |||

| Devyani International Ltd. | 5203000 | 8585.99 | 1.16 |

| ITC Hotels Ltd. | 230300 | 377.25 | 0.05 |

| Petroleum Products | |||

| Reliance Industries Ltd. | 2800000 | 33602.80 | 4.53 |

| Pharmaceuticals & Biotechnology | |||

| Lupin Ltd. | 700000 | 13332.55 | 1.80 |

| Wockhardt Ltd. | 800000 | 9244.00 | 1.25 |

| Alkem Laboratories Ltd. | 62937 | 2924.18 | 0.39 |

| Dr Reddys Laboratories Ltd. | 250000 | 2791.25 | 0.38 |

| Divi Laboratories Ltd. | 27375 | 1500.22 | 0.20 |

| Power | |||

| Adani Energy Solutions Ltd. | 1157787 | 7536.04 | 1.02 |

| Realty | |||

| Godrej Properties Ltd. | 750000 | 14522.25 | 1.96 |

| Retailing | |||

| Aditya Birla Fashion & Retail Ltd. | 3471960 | 8407.35 | 1.13 |

| Telecom - Services | |||

| Bharti Airtel Ltd. | 1573632 | 24709.17 | 3.33 |

| Tata Communications Ltd. | 1000000 | 13525.00 | 1.82 |

| Bharti Airtel Ltd. (Right 14/10/2021) (Partly Paid) | 103571 | 1155.65 | 0.16 |

| Repo | 23380.66 | 3.15 | |

| Portfolio Total | 722544.54 | 97.39 | |

| Cash / Net Current Asset | 19412.90 | 2.61 | |

| Net Assets | 741957.44 | 100.00 | |

| Issuer Name | % to NAV |

| HDFC Bank Ltd. | 10.43 |

| Reliance Industries Ltd. | 4.53 |

| ICICI Bank Ltd. | 4.14 |

| P.i. Industries Ltd. | 4.09 |

| State Bank Of India | 4.04 |

| Varun Beverages Ltd. | 3.99 |

| Sbi Cards & Payment Services Ltd. | 3.63 |

| Bharti Airtel Ltd. | 3.49 |

| IDFC First Bank Ltd. | 3.42 |

| Fortis Healthcare Ltd. | 2.95 |

| Total | 44.71 |

| Large Cap | 46.17% |

| Mid Cap | 38.47% |

| Small Cap | 15.36% |

| Market Capitalisation is as per list provided by AMFI. | |