| Tata Nifty Capital Markets Index Fund

(An open-ended scheme replicating / tracking Nifty Capital Markets Index (TRI)) |

|

As on 28th February 2025

|

An open-ended scheme replicating / tracking Nifty Capital Markets Index (TRI)

INVESTMENT OBJECTIVE:The investment objective of the scheme is to provide returns, before expenses, that commensurate with the performance of Nifty Capital Markets Index (TRI), subject to tracking error.However, there is no assurance or guarantee that the investment objective of the scheme will be achieved. The scheme does not assure or guarantee any returns.

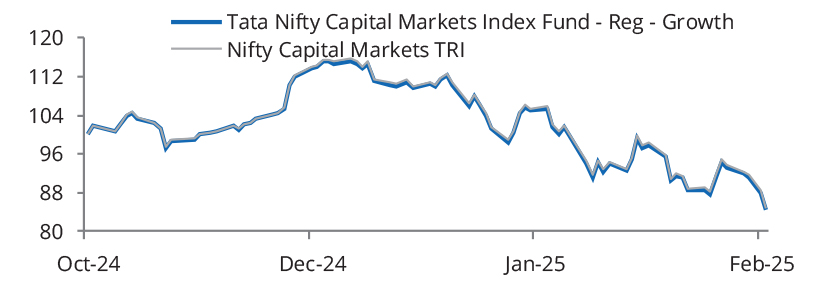

DATE OF ALLOTMENT:October 24, 2024

FUND MANAGER(S)Kapil Menon (Managing Since 24-Oct-24 and overall experience of 21 years)

ASSISTANT FUND MANAGER:R akesh Ind rajeet Praj apati (Managing Since 20-Dec-24 and overall experience of 19 years)

BENCHMARK:Nifty Capital Markets TRI

NAV (in Rs.)| Direct - Growth | : 8.4064 |

| Direct - IDCW | : 8.4064 |

| Reg - Growth | : 8.3877 |

| Reg - IDCW | : 8.3877 |

| FUND SIZE | |

| Rs. 120.13 (Rs. in Cr.) | |

| MONTHLY AVERAGE AUM | |

| Rs. 127.56 (Rs. in Cr.) | |

| TURN OVER | |

| Portfolio Turnover (Equity component only) | 19.96% |

| EXPENSE RATIO** | |

| Direct | 0.30 |

| Regular | 1.05 |

| **Note: The rates specified are actual month end expenses charged

as on Feb 28, 2025. The above ratio includes the GST on Investment

Management Fees. The above ratio excludes, borrowing cost,

wherever applicable. ^Risk-free rate based on the FBIL Overnight MIBOR rate of 6.4% as on Feb 28, 2025 For calculation methodology | |

MULTIPLES FOR NEW INVESTMENT:

Rs.5,000/- and in multiple of Re.1/- thereafter.

ADDITIONAL INVESTMENT/MULTIPLES FOR EXISTING INVESTORS:

Rs.1,000/- and in multiples of Re.1/-thereafter.

LOAD STRUCTURE:| ENTRY LOAD | Not Applicable |

| EXIT LOAD |

0.25% of the applicable NAV, if redeemed

on or before 15 days from the date of

allotment |

Please refer to our Tata Mutual Fund website for fundamental changes, wherever applicable

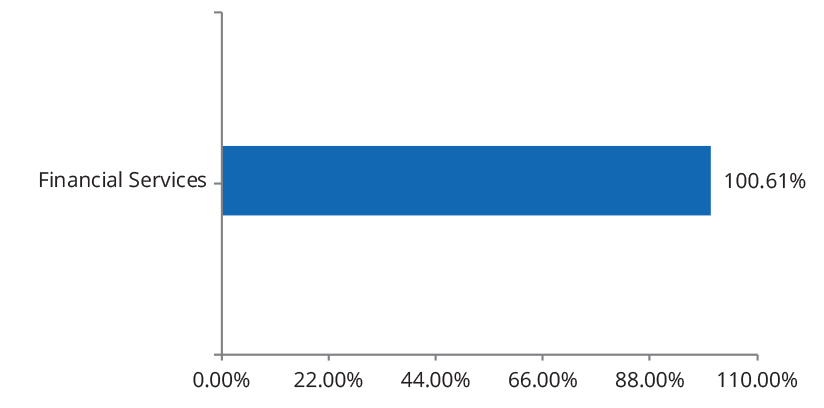

| Company name | No. of Shares | Market Value Rs Lakhs | % of Assets |

| Equity & Equity Related Total | 12087.26 | 100.63 | |

| Capital Markets | |||

| Bse Ltd. | 58336 | 2703.12 | 22.50 |

| HDFC Asset Management Company Ltd. | 49950 | 1812.34 | 15.09 |

| Multi Commodity Exchange Of Ind Ltd. | 25153 | 1255.55 | 10.45 |

| Central Depository Services (India) Ltd. | 87792 | 972.65 | 8.10 |

| 360 One Wam Ltd. | 95898 | 957.35 | 7.97 |

| Computer Age Management Services Ltd. | 23596 | 741.65 | 6.17 |

| Angel One Ltd. | 28578 | 619.90 | 5.16 |

| Indian Energy Exchange Ltd. | 373393 | 582.23 | 4.85 |

| Kfin Technologies Ltd. | 56822 | 494.72 | 4.12 |

| Nippon Life India Asset Management Ltd. | 85852 | 440.68 | 3.67 |

| Motilal Oswal Financial Service Ltd. | 72662 | 427.62 | 3.56 |

| Anand Rathi Wealth Ltd. | 8702 | 348.17 | 2.90 |

| Nuvama Wealth Management Ltd. | 5941 | 320.84 | 2.67 |

| Aditya Birla Sun Life Amc Ltd. | 35688 | 219.66 | 1.83 |

| Uti Asset Management Company Ltd. | 20276 | 190.78 | 1.59 |

| Repo | 44.09 | 0.37 | |

| Portfolio Total | 12131.35 | 101.00 | |

| Net Current Liabilities | -117.95 | -1.00 | |

| Net Assets | 12013.40 | 100.00 | |

| Issuer Name | % to NAV |

| Bse Ltd. | 22.5 |

| HDFC Asset Management Company Ltd. | 15.09 |

| Multi Commodity Exchange Of Ind Ltd. | 10.45 |

| Central Depository Services (india) Ltd. | 8.10 |

| 360 One Wam Ltd.(erstwhile Iifl Wealth Management Ltd) | 7.97 |

| Computer Age Management Services Ltd | 6.17 |

| Angel One Ltd. | 5.16 |

| Indian Energy Exchange Ltd. | 4.85 |

| Kfin Technologies Ltd. | 4.12 |

| Nippon Life India Asset Management Ltd. | 3.67 |

| Total | 88.08 |

| Large Cap | 0.00% |

| Mid Cap | 52.46% |

| Small Cap | 47.54% |

| Market Capitalisation is as per list provided by AMFI. | |