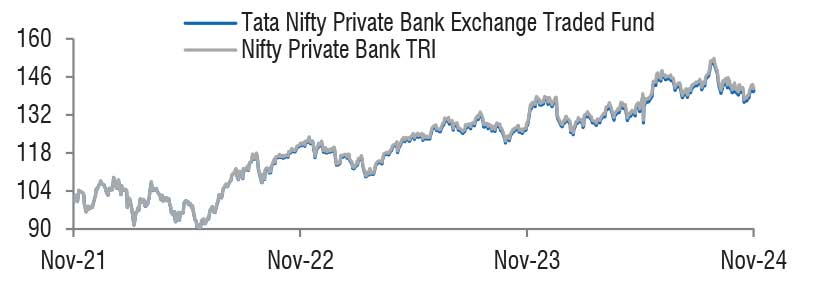

| Tata Nifty Private Bank Exchange Traded Fund

(An Open-Ended Exchange Traded Fund replicating/ tracking -Nifty Private Bank Index) |

|

As on 28th February 2025

|

Exchange Traded Fund replicating / tracking Nifty Private Bank Index.

INVESTMENT OBJECTIVE:The investment objective of the scheme is to provide returns that is closely correspond to the total returns of the securities as represented by the Nifty Private Bank index, subject to tracking error. However, there is no assurance or guarantee that the investment objective of the Scheme will be achieved.

DATE OF ALLOTMENT:August 30, 2019

FUND MANAGER(S)Kapil Menon (Managing Since 26-Apr-24 and overall experience of 21 years)

ASSISTANT FUND MANAGER:Rakesh Indrajeet Prajapati (Managing Since 20-Dec-24 and overall experience of 19 years)

BENCHMARK:Nifty Private Bank TRI

NAV (in Rs.)| Direct - Growth | : 248.8505 |

| FUND SIZE | |

| Rs. 10.86 (Rs. in Cr.) | |

| MONTHLY AVERAGE AUM | |

| Rs. 11.02 (Rs. in Cr.) | |

| TURN OVER | |

| Portfolio Turnover (Equity component only) | 37.43% |

| EXPENSE RATIO** | |

| Direct | 0.14 |

| Regular | NA |

| **Note: The rates specified are actual month end expenses charged as on Feb 28, 2025. The above ratio includes the Service tax on Investment Management Fees. The above ratio excludes, borrowing cost, wherever applicable. | |

| VOLATILITY MEASURES^ | FUND | BENCHMARK |

| Std. Dev (Annualised) | 15.01 | 15.09 |

| Sharpe Ratio | 0.29 | 0.31 |

| Portfolio Beta | 0.97 | NA |

| R Squared | 1.00 | NA |

| Treynor | 0.38 | NA |

| Jenson | -0.01 | NA |

| ^Risk-free rate based on the FBIL Overnight MIBOR

rate of 6.4% as on Feb 28, 2025 For calculation methodology | ||

MULTIPLES FOR NEW INVESTMENT:

Transactions by Market Makers: in creation unit size (refer SID

for creation unit size)

Transactions by Investors:

• Amount greater than 25 Crs: Directly through AMC or

through exchange

• Amount less than 25 Crs: Through exchange, min 1 unit

and in multiple thereof

MULTIPLES FOR EXISTING INVESTORS:

Transactions by Market Makers: in creation unit size (refer SID

for creation unit size)

Transactions by Investors:

• Amount greater than 25 Crs: Directly through AMC or

through exchange

• Amount less than 25 Crs: Through exchange, min 1 unit

and in multiple thereof

| ENTRY LOAD | Not Applicable |

| EXIT LOAD | Nil |

Please refer to our Tata Mutual Fund website for fundamental changes, wherever applicable

| Company Name | No. of Shares | Market Value Rs Lakhs | % of assets |

| Equity & Equity Related Total | 1085.69 | 99.99 | |

| Banks | |||

| Kotak Mahindra Bank Ltd. | 12780 | 243.20 | 22.40 |

| HDFC Bank Ltd. | 12981 | 224.88 | 20.71 |

| ICICI Bank Ltd. | 17918 | 215.75 | 19.87 |

| Axis Bank Ltd. | 20798 | 211.21 | 19.45 |

| Indusind Bank Ltd. | 7120 | 70.50 | 6.49 |

| Federal Bank Ltd. | 26403 | 46.90 | 4.32 |

| IDFC First Bank Ltd. | 66739 | 38.97 | 3.59 |

| Bandhan Bank Ltd. | 8962 | 12.65 | 1.17 |

| City Union Bank Ltd. | 7767 | 11.48 | 1.06 |

| Rbl Bank Ltd. | 6411 | 10.15 | 0.93 |

| Portfolio Total | 1085.69 | 99.99 | |

| Cash / Net Current Asset | 0.03 | 0.01 | |

| Net Assets | 1085.72 | 100.00 | |

| Note: As per the guidance issued by AMFI vide correspondence 35P/MEM-COR/57/2019-20,any realization

of proceeds from the locked-in shares of Yes Bank Ltd. (which is 3 years from the commencement of the

Revival scheme i.e March 13,2020) shall be distributed (post conclusion of the lock in period) among the

set of investors existing in the unit holders’ register / BENPOS as on end of March 13, 2020.For further

details refer our website https://www.tatamutualfund.com/docs/default-source/statutory-disclosures/valuation-current-update/valu ation-update-17-03-2020.pdf?sfvrsn=aa8cd899_2 | |||

| Issuer Name | % to NAV |

| Kotak Mahindra Bank | 22.40 |

| HDFC Bank Ltd. | 20.71 |

| ICICI Bank Ltd. | 19.87 |

| Axis Bank Ltd. | 19.45 |

| Indusind Bank Ltd. | 6.49 |

| Federal Bank Ltd. | 4.32 |

| IDFC First Bank Ltd. | 3.59 |

| Bandhan Bank Ltd. | 1.17 |

| City Union Bank Ltd. | 1.06 |

| Rbl Bank Ltd. | 0.93 |

| Total | 99.99 |

| Large Cap | 82.44% |

| Mid Cap | 14.40% |

| Small Cap | 3.16% |

| Market Capitalisation is as per list provided by AMFI. | |