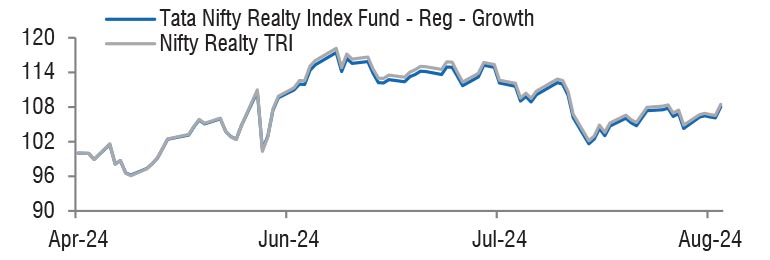

| Tata Nifty Realty Index Fund

(An open-ended scheme replicating / tracking Nifty Realty Index (TRI)) |

|

As on 28th February 2025

|

An open-ended scheme replicating / tracking Nifty Assets Realty Index (TRI)

INVESTMENT OBJECTIVE:The investment objective of the scheme is to provide returns, before expenses, that commensurate with the performance of Nifty Realty (TRI), subject to tracking error. There is no assurance or guarantee that the investment objective of the scheme will be achieved. The scheme does not assure or guarantee any returns.

DATE OF ALLOTMENT:April 26, 2024

FUND MANAGER(S)Kapil Menon (Managing Since 08-Apr-24 and overall experience of 21 years)

ASSISTANT FUND MANAGER:Rakesh Indrajeet Prajapati (Managing Since 20-Dec-24 and overall experience of 19 years)

BENCHMARK:Nifty Realty TRI

NAV (in Rs.)| Direct - Growth | : 8.2085 |

| Direct - IDCW | : 8.2085 |

| Reg - Growth | : 8.1553 |

| Reg - IDCW | : 8.1553 |

| FUND SIZE | |

| Rs. 44.99 (Rs. in Cr.) | |

| MONTHLY AVERAGE AUM | |

| Rs. 48.64 (Rs. in Cr.) | |

| TURN OVER | |

| Portfolio Turnover (Equity component only) | 93.63% |

| EXPENSE RATIO** | |

| Direct | 0.42 |

| Regular | 1.09 |

| **Note: The rates specified are actual month end expenses charged as on Feb 28, 2025. The above ratio includes the GST on Investment Management Fees. The above ratio excludes, borrowing cost, wherever applicable. | |

| ^Risk-free rate based on the FBIL Overnight MIBOR rate of 6.4% as

on Feb 28, 2025 For calculation methodology |

MULTIPLES FOR NEW INVESTMENT:

Rs. 5,000/- and in multiples of Re. 1/- thereafter.

ADDITIONAL INVESTMENT/MULTIPLES FOR EXISTING INVESTORS:

Rs. 1,000/- and multiples of Re. 1/- thereafter.

LOAD STRUCTURE:| ENTRY LOAD | Not Applicable |

| EXIT LOAD |

0.25 % of the applicable NAV, if

redeemed on or before 15 days from the

date of allotment. |

Please refer to our Tata Mutual Fund website for fundamental changes, wherever applicable

| Company Name | No. of Shares | Market Value Rs Lakhs | % of assets |

| Equity & Equity Related Total | 4503.19 | 100.11 | |

| Realty | |||

| Dlf Ltd. | 150861 | 958.80 | 21.31 |

| Macrotech Developers Ltd. | 65544 | 741.24 | 16.48 |

| Godrej Properties Ltd. | 35471 | 686.82 | 15.27 |

| The Phoenix Mills Ltd. | 43842 | 678.72 | 15.09 |

| Prestige Estates Projects Ltd. | 39659 | 446.80 | 9.93 |

| Oberoi Realty Ltd. | 27671 | 410.78 | 9.13 |

| Brigade Enterprises Ltd. | 32479 | 307.59 | 6.84 |

| Sobha Ltd. | 9549 | 114.65 | 2.55 |

| Raymond Ltd. | 7858 | 101.63 | 2.26 |

| Mahindra Lifespace Developers Ltd. | 17723 | 56.16 | 1.25 |

| Repo | 3.15 | 0.07 | |

| Portfolio Total | 4506.34 | 100.18 | |

| Net Current Liabilities | -7.35 | -0.18 | |

| Net Assets | 4498.99 | 100.00 | |

| Issuer Name | % to NAV |

| Dlf Ltd. | 21.31 |

| Macrotech Developers Ltd. | 16.48 |

| Godrej Properties Ltd. | 15.27 |

| The Phoenix Mills Ltd. | 15.09 |

| Prestige Estates Projects Ltd. | 9.93 |

| Oberoi Realty Ltd. | 9.13 |

| Brigade Enterprises Ltd. | 6.84 |

| Sobha Ltd. | 2.55 |

| Raymond Ltd. | 2.26 |

| Mahindra Lifespace Developers Ltd. | 1.25 |

| Total | 100.11 |

| Large Cap | 37.75% |

| Mid Cap | 49.37% |

| Small Cap | 12.88% |

| Market Capitalisation is as per list provided by AMFI. | |