| Tata Nifty SDL Plus AAA PSU Bond Dec 2027 60:40 Index Fund

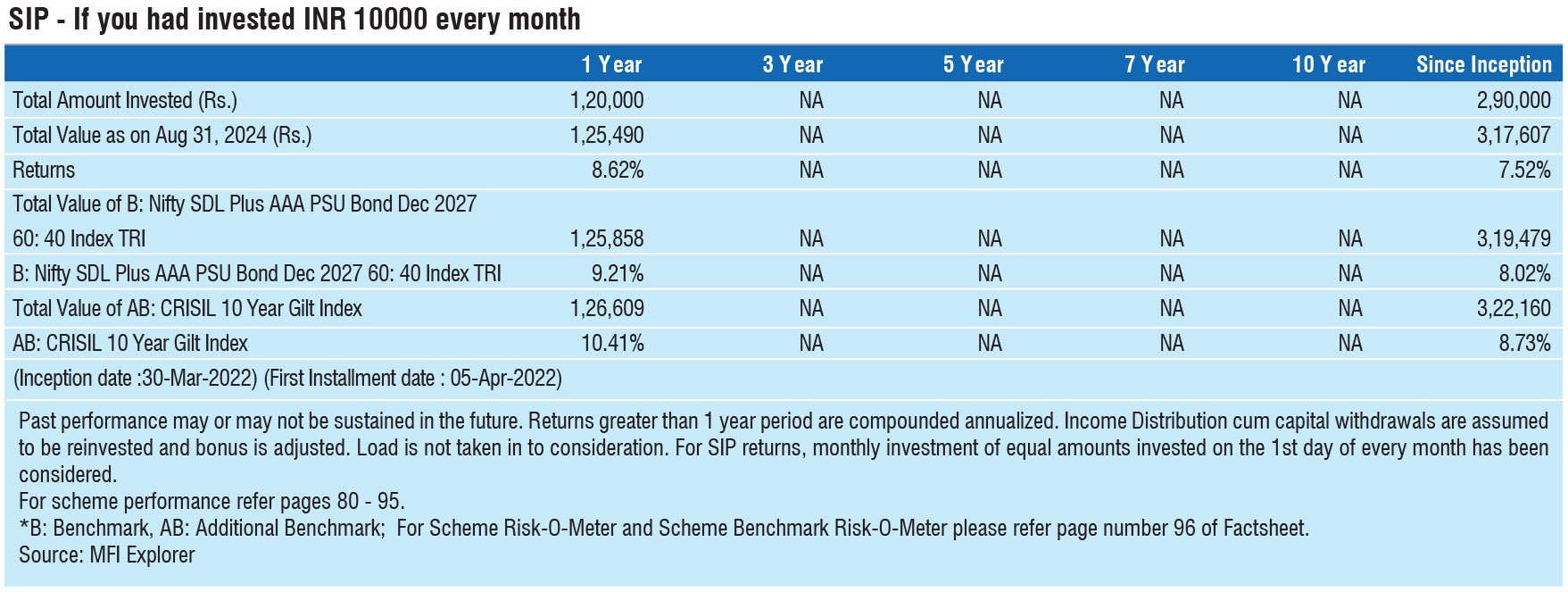

(An open-ended Target Maturity Index Fund investing in constituents of Nifty SDL Plus AAA PSU Bond Dec 2027 60:40 Index. A Scheme with Relatively High Interest |

|

As on 28th February 2025

|

An open-ended Target Maturity Index Fund investing in constituents of Nifty SDL Plus AAA PSU Bond Dec 2027 60:40 Index. A Scheme with Relatively High Interest Rate Risk and Relatively Low Credit Risk.

INVESTMENT OBJECTIVE:The investment objective of the scheme is to provide returns that correspond to the total returns of the securities as represented by the underlying index, subject to tracking error. There is no guarantee or assurance that the investment objective of the scheme will be achieved. The scheme doesn’t assure or guarantee any returns.

DATE OF ALLOTMENT:March 30, 2022

FUND MANAGER(S)Amit Somani (Managing Since 30-Mar-2022 and overall experience of 23 years)

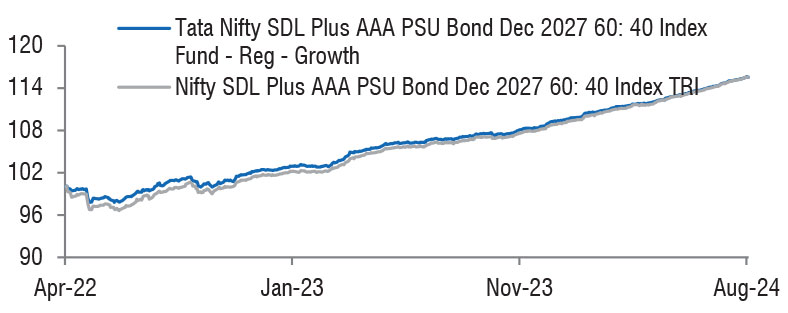

BENCHMARK:Nifty SDL Plus AAA PSU Bond Dec 2027 60: 40 Index TRI

NAV (in Rs.)| Direct - Growth | : 12.0674 |

| Direct - IDCW | : 12.0674 |

| Reg - Growth | : 11.9687 |

| Reg - IDCW | : 11.9687 |

| FUND SIZE | |

| Rs. 854.60(Rs. in Cr.) | |

| MONTHLY AVERAGE AUM | |

| Rs. 868.17 (Rs. in Cr.) | |

| EXPENSE RATIO** | |

| Direct | 0.22 |

| Regular | 0.47 |

| **Note: The rates specified are actual month end expenses charged as on Feb 28, 2025. The above ratio includes the GST on Investment Management Fees. The above ratio excludes, borrowing cost, wherever applicable. | |

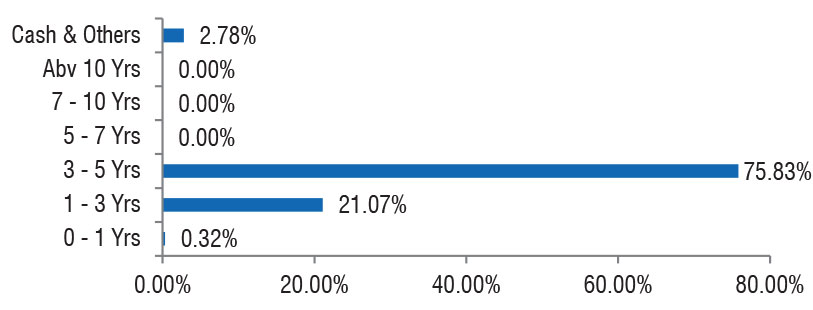

| Portfolio Macaulay Duration | : | 2.39 Years |

| Modified Duration | : | 2.28 Years |

| Average Maturity | : | 2.63 Years |

| Annualized Yield to Maturity (For Debt Component)* | ||

| - Including Net Current Assets | : | 7.16% |

| *Computed on the invested amount for debt portfolio | ||

| YTM, Macaulay Duration and Modified Duration is post adjustment of

IRS positions in the Fund. For details of IRS positions please refer to

Monthly Portfolio. ^Risk-free rate based on the FBIL Overnight MIBOR rate of 6.4% as on Feb 28, 2025 For calculation methodology | ||

MULTIPLES FOR NEW INVESTMENT:

Rs. 5,000/- and in multiples of Re. 1/- thereafter.

ADDITIONAL INVESTMENT/MULTIPLES FOR EXISTING INVESTORS:

Rs. 1,000/- and multiples of Re. 1/- thereafter.

LOAD STRUCTURE:| ENTRY LOAD | Not Applicable |

| EXIT LOAD |

Nil |

Please refer to our Tata Mutual Fund website for fundamental changes, wherever applicable

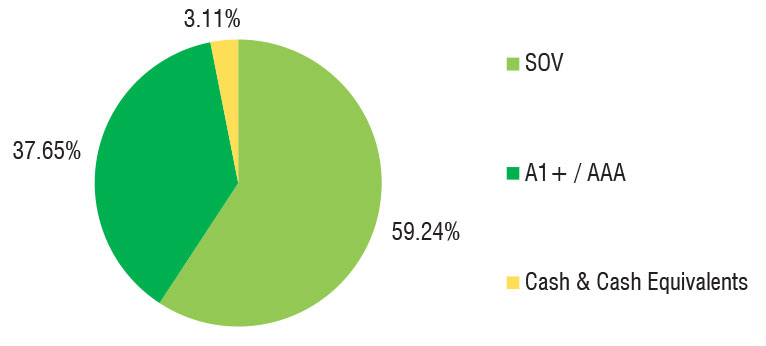

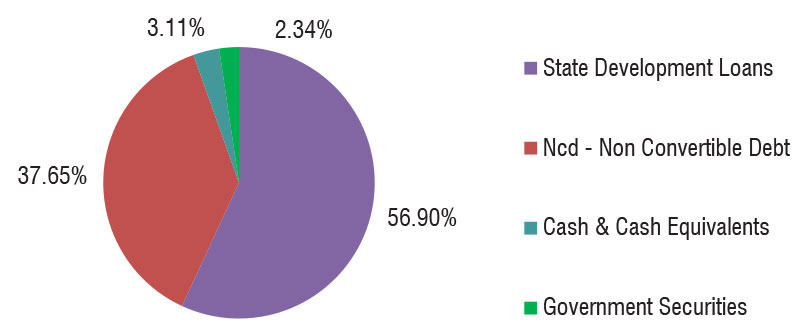

| Name of the Instrument | Ratings | Market Value Rs Lakhs | % to NAV |

| Debt Instruments | |||

| Government Securities | 51340.37 | 60.08 | |

| SDL Gujarat 7.64% (08/11/2027) | SOV | 7421.47 | 8.68 |

| SDL Tamilnadu 7.65% (06/12/2027) | SOV | 5123.93 | 6.00 |

| SDL Gujarat 7.75% (13/12/2027) | SOV | 4088.76 | 4.78 |

| SDL Karnataka 7.76% (13/12/2027) | SOV | 3630.28 | 4.25 |

| SDL Uttar Pradesh 7.85% (27/12/2027) | SOV | 3380.93 | 3.96 |

| SDL Gujarat 7.19% (23/10/2027) | SOV | 2612.71 | 3.06 |

| SDL West Bengal 7.72% (20/12/2027) | SOV | 2552.14 | 2.99 |

| SDL Uttar Pradesh 7.67% (29/11/2027) | SOV | 2548.65 | 2.98 |

| SDL Rajasthan 7.86% (27/12/2027) | SOV | 2058.97 | 2.41 |

| SDL Gujarat 7.80% (27/12/2027) | SOV | 2047.50 | 2.40 |

| SDL Uttar Pradesh 7.59% (25/10/2027) | SOV | 2033.93 | 2.38 |

| GOI - 7.38% (20/06/2027) | SOV | 2033.90 | 2.38 |

| SDL Gujarat 7.62% (01/11/2027) | SOV | 1781.91 | 2.09 |

| SDL Karnataka 7.70% (15/11/2027) | SOV | 1634.86 | 1.91 |

| SDL Rajasthan 7.64% (01/11/2027) | SOV | 1526.79 | 1.79 |

| SDL Karnataka 7.82% (27/12/2027) | SOV | 1024.49 | 1.20 |

| SDL Rajasthan 7.65% (29/11/2027) | SOV | 1018.57 | 1.19 |

| SDL Karnataka 7.64% (08/11/2027) | SOV | 1019.00 | 1.19 |

| SDL Tamilnadu 7.69% (20/12/2027) | SOV | 1020.95 | 1.19 |

| SDL West Bengal 7.68% (06/12/2027) | SOV | 1019.59 | 1.19 |

| SDL Karnataka 7.65% (06/12/2027) | SOV | 509.87 | 0.60 |

| SDL Uttar Pradesh 7.56% (11/10/2027) | SOV | 508.03 | 0.59 |

| SDL Karnataka 7.55% (25/10/2027) | SOV | 508.32 | 0.59 |

| SDL Karnataka 7.69% (20/12/2027) | SOV | 204.20 | 0.24 |

| SDL Gujarat 7.69% (20/12/2027) | SOV | 30.62 | 0.04 |

| Non-Convertible Debentures/Bonds | 31605.84 | 36.97 | |

| 07.70 % Rec Ltd. | CRISIL AAA | 8842.81 | 10.35 |

| 07.27 % Indian Railways Finance Corporation Ltd. | CRISIL AAA | 4481.31 | 5.24 |

| 07.54 % Indian Railways Finance Corporation Ltd. | CRISIL AAA | 3703.57 | 4.33 |

| 07.20 % Power Grid Corporation Of India Ltd. | CRISIL AAA | 3680.06 | 4.31 |

| 07.95 % Rec Ltd. | CRISIL AAA | 2520.48 | 2.95 |

| 07.83 % Indian Railways Finance Corporation Ltd. | CRISIL AAA | 2516.14 | 2.94 |

| 07.65 % Power Finance Corporation | CRISIL AAA | 2345.44 | 2.74 |

| 07.30 % Power Grid Corporation Of India Ltd. | CRISIL AAA | 1405.76 | 1.64 |

| 07.59 % National Housing Bank | CRISIL AAA | 1003.05 | 1.17 |

| 07.33 % Indian Railways Finance Corporation Ltd. | CRISIL AAA | 947.18 | 1.11 |

| 07.49 % Indian Railways Finance Corporation Ltd. | CRISIL AAA | 160.04 | 0.19 |

| Repo | 355.95 | 0.42 | |

| Portfolio Total | 83302.16 | 97.47 | |

| Cash / Net Current Asset | 2158.00 | 2.53 | |

| Net Assets | 85460.16 | 100.00 | |