| TATA Nifty500 Multicap India Manufacturing 50:30:20 Index Fund

(An open-ended scheme replicating/tracking Nifty500 Multicap India Manufacturing 50:30:20 Index) |

|

As on 28th February 2025

|

An open-ended scheme replicating/tracking Nifty500 Multicap India Manufacturing 50:30:20 Index

INVESTMENT OBJECTIVE:The investment objective of the scheme is to provide returns, before expenses, that are in line with the performance of Nifty500 Multicap India Manufacturing 50:30:20 Index (TRI), subject to tracking error. However ,there is no assurance or guarantee that the investment objective of the scheme will be achieved. The scheme does not assure or guarantee any returns.

DATE OF ALLOTMENT:April 26, 2024

FUND MANAGER(S)Kapil Menon (Managing Since 26-Apr-24 and overall experience of 21 years)

ASSISTANT FUND MANAGER:Rakesh Indrajeet Prajapati (Managing Since 20-Dec-24 and overall experience of 19 years)

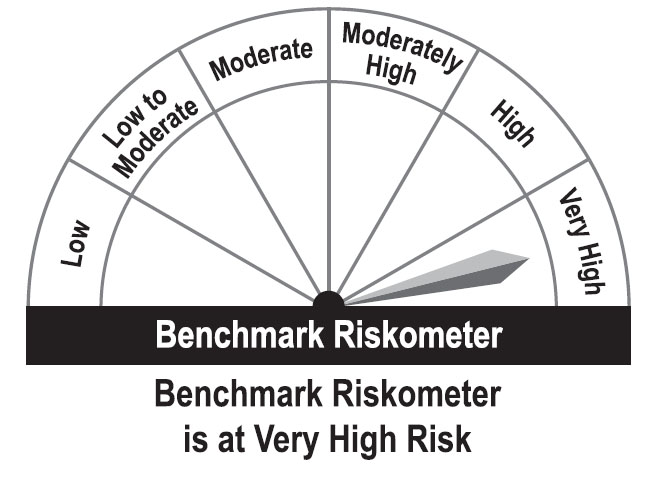

BENCHMARK:Nifty500 Multicap India Manufacturing 50:30:20 Index (TRI)

NAV (in Rs.)| Direct - Growth | : 9.5421 |

| Direct - IDCW | : 9.5421 |

| Reg - Growth | : 9.4845 |

| Reg - IDCW | : 9.4845 |

| FUND SIZE | |

| Rs. 106.24 (Rs. in Cr.) | |

| MONTHLY AVERAGE AUM | |

| Rs. 112.5 (Rs. in Cr.) | |

| TURN OVER | |

| Portfolio Turnover (Equity component only) | 23.94% |

| EXPENSE RATIO** | |

| Direct | 0.47 |

| Regular | 1.10 |

| **Note: The rates specified are actual month end expenses charged as on Feb 28, 2025. The above ratio includes the GST on Investment Management Fees. The above ratio excludes, borrowing cost, wherever applicable. | |

| ^Risk-free rate based on the FBIL Overnight MIBOR rate of 6.4% as

on Feb 28, 2025 For calculation methodology |

MULTIPLES FOR NEW INVESTMENT:

Rs. 5,000/- and in multiples of Re. 1/- thereafter.

ADDITIONAL INVESTMENT/MULTIPLES FOR EXISTING INVESTORS:

Rs. 1,000/- and multiples of Re. 1/- thereafter.

LOAD STRUCTURE:| ENTRY LOAD | Not Applicable |

| EXIT LOAD |

0.25 % of the applicable NAV, if

redeemed on or before 15 days from the

date of allotment.

|

Please refer to our Tata Mutual Fund website for fundamental changes, wherever applicable

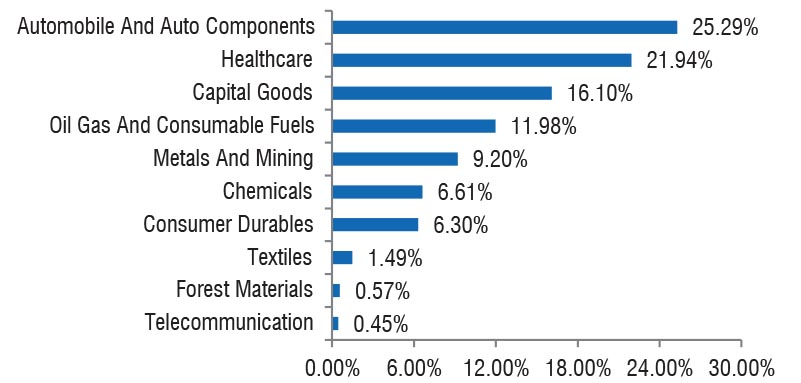

| Company Name | No. of Shares | Market Value Rs Lakhs | % of assets |

| Equity & Equity Related Total | 10628.47 | 100.05 | |

| Aerospace And Defense | |||

| Bharat Electronics Ltd. | 106597 | 262.50 | 2.47 |

| Hindustan Aeronautics Ltd. | 5661 | 174.82 | 1.65 |

| Agricultural, Commercial & Construction Vehicles | |||

| Ashok Leyland Ltd. | 69762 | 148.55 | 1.40 |

| Auto Components | |||

| Bharat Forge Ltd. | 12749 | 129.59 | 1.22 |

| MRF Ltd. | 98 | 103.27 | 0.97 |

| Balkrishna Industries Ltd. | 3914 | 102.38 | 0.96 |

| Exide Industries Ltd. | 22163 | 77.08 | 0.73 |

| Amara Raja Energy & Mobility Ltd. | 6840 | 66.97 | 0.63 |

| Apollo Tyres Ltd. | 16208 | 60.67 | 0.57 |

| Asahi India Glass Ltd. | 6146 | 37.84 | 0.36 |

| Ramkrishna Forgings Ltd. | 5737 | 37.18 | 0.35 |

| Cie Automotive India Ltd. | 7113 | 26.75 | 0.25 |

| Automobiles | |||

| Mahindra & Mahindra Ltd. | 26389 | 682.18 | 6.42 |

| Maruti Suzuki India Ltd. | 3922 | 468.52 | 4.41 |

| Tata Motors Ltd. | 62478 | 387.77 | 3.65 |

| Bajaj Auto Ltd. | 3307 | 261.35 | 2.46 |

| Eicher Motors Ltd. | 4101 | 195.77 | 1.84 |

| Hero Motocorp Ltd. | 3863 | 142.20 | 1.34 |

| Chemicals & Petrochemicals | |||

| Srf Ltd. | 7070 | 197.63 | 1.86 |

| Navin Fluorine International Ltd. | 1949 | 73.33 | 0.69 |

| Deepak Nitrite Ltd. | 3346 | 61.94 | 0.58 |

| Tata Chemicals Ltd. | 7627 | 59.29 | 0.56 |

| Atul Ltd. | 888 | 47.15 | 0.44 |

| Aarti Industries Ltd. | 11382 | 42.80 | 0.40 |

| Guj Narmada Valley Fer. & Chem. Ltd. | 4665 | 21.87 | 0.21 |

| Consumer Durables | |||

| Dixon Technologies (India) Ltd. | 1859 | 259.07 | 2.44 |

| Voltas Ltd. | 11123 | 146.83 | 1.38 |

| Blue Star Ltd. | 7250 | 139.03 | 1.31 |

| Crompton Greaves Consumer Electricals Ltd. | 35977 | 115.54 | 1.09 |

| Amber Enterprises India Ltd. | 1058 | 59.55 | 0.56 |

| Bata India Ltd. | 3566 | 43.54 | 0.41 |

| Kajaria Ceramics Ltd. | 4649 | 39.62 | 0.37 |

| Whirlpool Of India Ltd. | 3480 | 32.30 | 0.30 |

| Ferrous Metals | |||

| Tata Steel Ltd. | 246974 | 338.85 | 3.19 |

| Jsw Steel Ltd. | 28603 | 271.93 | 2.56 |

| Steel Authority India Ltd. | 70397 | 73.93 | 0.70 |

| Fertilizers & Agrochemicals | |||

| Upl Ltd. | 24644 | 155.98 | 1.47 |

| Pi Industries Ltd. | 3954 | 119.17 | 1.12 |

| Coromandel International Ltd. | 5728 | 95.48 | 0.90 |

| Chambal Fertiliser & Chemicals Ltd. | 8527 | 45.51 | 0.43 |

| Industrial Manufacturing | |||

| Kaynes Technology India Ltd. | 1513 | 62.70 | 0.59 |

| Praj Industries Ltd. | 6883 | 33.62 | 0.32 |

| Titagarh Rail Systems Ltd. | 4475 | 31.19 | 0.29 |

| Industrial Products | |||

| Cummins India Ltd. | 6603 | 179.47 | 1.69 |

| Polycab India Ltd. | 2450 | 115.48 | 1.09 |

| Astral Ltd. (Erstwhile Astral Poly Technik Ltd.) | 6021 | 80.52 | 0.76 |

| Welspun Corp Ltd. | 7295 | 53.76 | 0.51 |

| Elgi Equipments Ltd. | 12057 | 51.62 | 0.49 |

| Ratnamani Metals & Tubes Ltd. | 1449 | 35.63 | 0.34 |

| Finolex Cables Ltd. | 4228 | 34.54 | 0.33 |

| Finolex Industries Ltd. | 15856 | 27.08 | 0.25 |

| Non - Ferrous Metals | |||

| Hindalco Industries Ltd. | 43327 | 274.84 | 2.59 |

| National Aluminium Co. Ltd. | 50067 | 88.92 | 0.84 |

| Hindustan Copper Ltd. | 18324 | 37.07 | 0.35 |

| Paper, Forest & Jute Products | |||

| Aditya Birla Real Estate Ltd. | 2922 | 54.44 | 0.51 |

| Petroleum Products | |||

| Reliance Industries Ltd. | 99642 | 1195.80 | 11.26 |

| Hindustan Petroleum Corporation Ltd. | 46782 | 137.42 | 1.29 |

| Castrol India Ltd. | 27017 | 57.45 | 0.54 |

| Pharmaceuticals & Biotechnology | |||

| Sun Pharmaceutical Industries Ltd. | 32174 | 512.61 | 4.82 |

| Cipla Ltd. | 16383 | 230.59 | 2.17 |

| Lupin Ltd. | 11755 | 223.89 | 2.11 |

| Dr Reddys Laboratories Ltd. | 18178 | 202.96 | 1.91 |

| Aurobindo Pharma Ltd. | 13621 | 144.15 | 1.36 |

| Alkem Laboratories Ltd. | 2587 | 120.20 | 1.13 |

| Laurus Labs Ltd. | 21982 | 115.89 | 1.09 |

| Glenmark Pharmaceuticals Ltd. | 8414 | 107.61 | 1.01 |

| Ipca Laboratories Ltd. | 6613 | 89.63 | 0.84 |

| Suven Pharmaceuticals Ltd. | 7093 | 86.16 | 0.81 |

| Abbott India Ltd. | 253 | 76.90 | 0.72 |

| J.B.Chemicals & Pharmaceuticals Ltd. | 3994 | 65.68 | 0.62 |

| Piramal Pharma Ltd. | 34403 | 65.33 | 0.61 |

| Natco Pharma Ltd. | 4997 | 38.51 | 0.36 |

| Granules India Ltd. | 8089 | 37.36 | 0.35 |

| Telecom - Equipment & Accessories | |||

| Tejas Networks Ltd. | 4356 | 30.96 | 0.29 |

| Textiles & Apparels | |||

| Page Industries Ltd. | 303 | 122.76 | 1.16 |

| Repo | 6.30 | 0.06 | |

| Portfolio Total | 10634.77 | 100.11 | |

| Net Current Liabilities | -10.47 | -0.11 | |

| Net Assets | 10624.30 | 100.00 | |

| Issuer Name | % to NAV |

| Reliance Industries Ltd. | 11.26 |

| Mahindra & Mahindra Ltd. | 6.42 |

| Sun Pharmaceutical Industries Ltd. | 4.82 |

| Maruti Suzuki India Ltd. | 4.41 |

| Tata Motors Ltd. | 3.65 |

| Tata Steel Ltd. | 3.19 |

| Hindalco Industries Ltd. | 2.59 |

| Jsw Steel Ltd. | 2.56 |

| Bharat Electronics Ltd. | 2.47 |

| Bajaj Auto Ltd. | 2.46 |

| Total | 43.83 |

| Large Cap | 55.49% |

| Mid Cap | 28.83% |

| Small Cap | 15.68% |

| Market Capitalisation is as per list provided by AMFI. | |