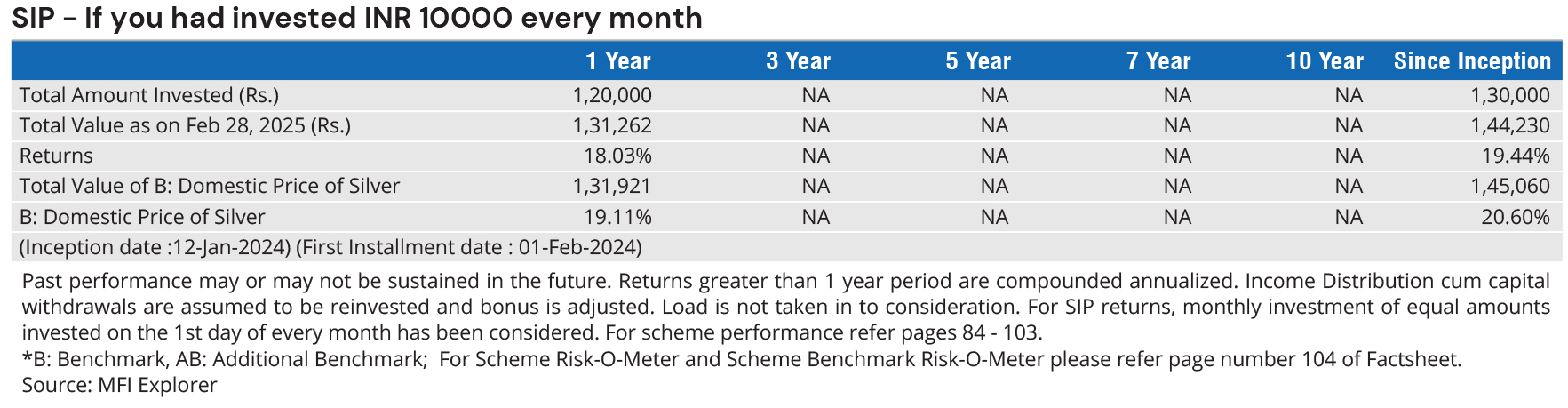

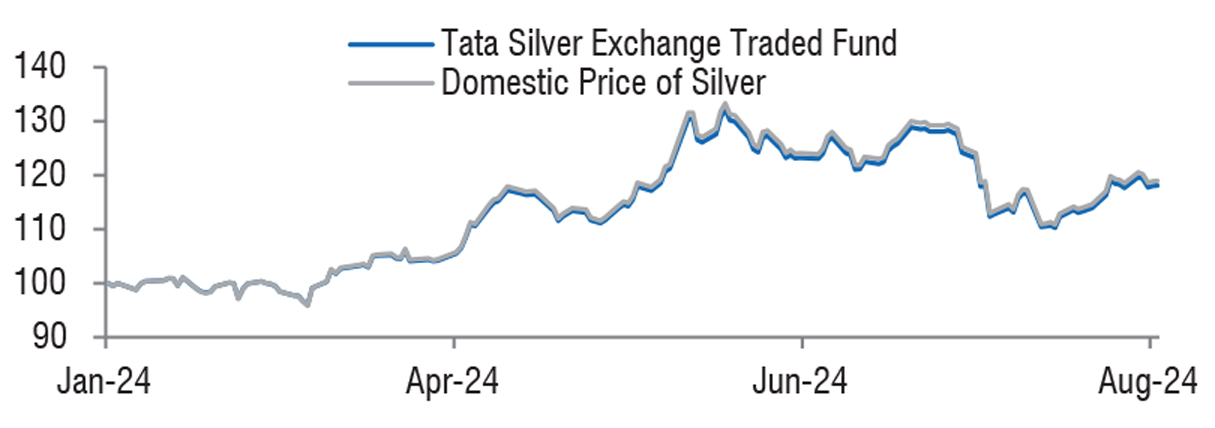

| Tata Silver Exchange Traded Fund

(An Open-Ended Exchange Traded Fund replicating / tracking domestic price of Silver)s |

|

As on 28th February 2025

|

An Open-Ended Exchange Traded Fund replicating / tracking domestic price of Silver.

INVESTMENT OBJECTIVE:The investment objective of the fund is to generate returns that are in line with the performance of physical silver in domestic prices, subject to tracking error. However, there is no assurance or guarantee that the investment objective of the Scheme will be achieved.

DATE OF ALLOTMENT:January 12,2024

FUND MANAGER(S)Tapan Patel (Lead Fund Manager) (Managing Since 12-Jan-24 and overall experience of 11 years) , Kapil Menon (Managing Since 26-Apr-24 and overall experience of 21 years)

BENCHMARK:Domestic Price of Silver

NAV (in Rs.)| Direct - Growth | : 9.1634 |

| FUND SIZE | |

| Rs. 143.45 (Rs. in Cr.) | |

| MONTHLY AVERAGE AUM | |

| Rs. 143.65 (Rs. in Cr.) | |

| TURN OVER | |

| Portfolio Turnover (Equity component only) | NA |

| EXPENSE RATIO** | |

| Direct | 0.50 |

| Regular | NA |

| **Note: The rates specified are actual month end expenses charged

as on Feb 28, 2025. The above ratio includes the Service tax on

Investment Management Fees. The above ratio excludes, borrowing

cost, wherever applicable. ^Risk-free rate based on the FBIL Overnight MIBOR rate of 6.4% as on Feb 28, 2025 For calculation methodology | |

MULTIPLES FOR NEW INVESTMENT:

Transactions by Market Makers: in creation unit size (refer

SID for creation unit size)

Transactions by Investors:

• Amount greater than 25 Crs: Directly through AMC or

through exchange

• Amount less than 25 Crs: Through exchange, min 1

unit and in multiple thereof

MULTIPLES FOR EXISTING INVESTORS:

Transactions by Market Makers: in creation unit size (refer

SID for creation unit size)

Transactions by Investors:

• Amount greater than 25 Crs: Directly through AMC or

through exchange

• Amount less than 25 Crs: Through exchange, min 1

unit and in multiple thereof

| ENTRY LOAD | Not Applicable |

| EXIT LOAD | Nil |

Please refer to our Tata Mutual Fund website for fundamental changes, wherever applicable

| Company name | Quantity | Market Value Rs Lakhs | % of Assets |

| Equity & Equity Related Total | 13956.62 | 97.29 | |

| Precious Metals | |||

| Silver Physical -Purity 999 | 15010.1845 | 13956.62 | 97.29 |

| Portfolio Total | 13956.62 | 97.29 | |

| Cash / Net Current Asset | 388.86 | 2.71 | |

| Net Assets | 14345.48 | 100.00 | |