| Tata Corporate Bond Fund

(An open-ended debt scheme predominantly investing in AA+ & above rated corporate bonds, with flexibility of any Macaulay Duration & relatively high interest |

|

As on 28th February 2025

|

Predominantly investing in AA+ & above rated corporate NAV bonds, with flexibility of any Macaulay Duration

INVESTMENT OBJECTIVE:The investment objective of the scheme is to generate returns over short to medium term by investing predominantly in corporate debt instruments. However, there is no guarantee or assurance that the investment objective of the scheme will be achieved. The scheme doesn’t assure or guarantee any returns.

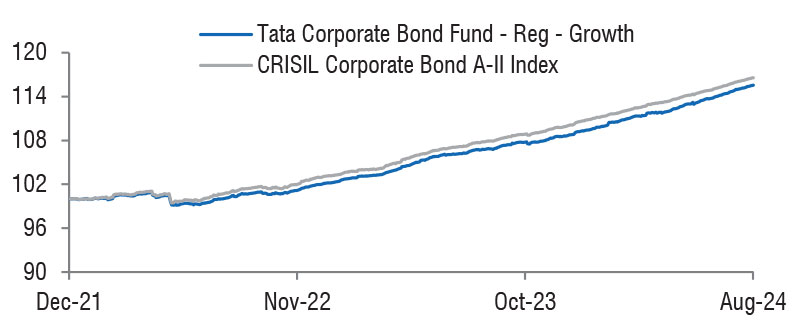

DATE OF ALLOTMENT:December 01,2021

FUND MANAGER(S)Abhishek Sonthalia (Managing Since 22-Nov-21 and overall experience of 16 years)

BENCHMARK:CRISIL Corporate Bond A-II Index

NAV (in Rs.)| Direct - Growth | 12.1880 |

| Direct - Monthly IDCW | 12.1880 |

| Direct - Periodic IDCW | 12.1880 |

| Direct - Quarterly IDCW | 12.1880 |

| Reg - Growth | 11.9628 |

| Reg - Monthly IDCW | 11.9628 |

| Reg - Periodic IDCW | 11.9628 |

| Reg - Quarterly IDCW | 11.9628 |

| FUND SIZE | |

| Rs. 3274.59 (Rs. in Cr.) | |

| MONTHLY AVERAGE AUM | |

| Rs. 3137.02 (Rs. in Cr.) | |

| EXPENSE RATIO** | |

| Direct | 0.32 |

| Regular | 0.87 |

| **Note: The rates specified are actual month end expenses charged as on Feb 28, 2025. The above ratio includes the GST on Investment Management Fees. The above ratio excludes, borrowing cost, wherever applicable. | |

| VOLATILITY MEASURES^ | FUND | BENCHMARK | |

| Std. Dev (Annualised) | 1.34 | 1.13 | |

| Portfolio Beta | 1.11 | NA | |

| R Squared | 0.92 | NA | |

| Treynor | -0.04 | NA | |

| Jenson | -0.02 | NA | |

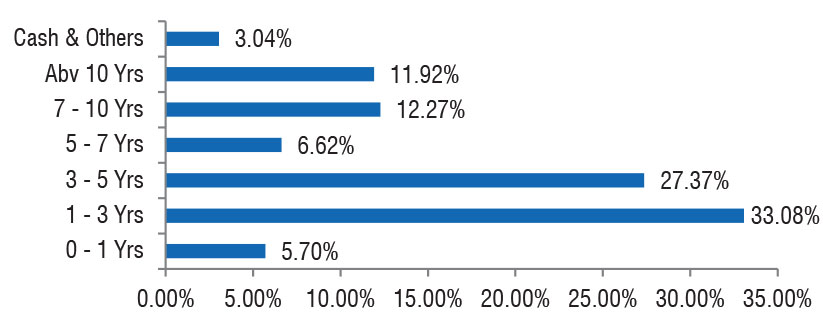

| Portfolio Macaulay Duration | : | 4.28 Years |

| Modified Duration | : | 4.08 Years |

| Average Maturity | : | 6.88 Years |

| Annualized Yield to Maturity (For Debt Component)* | ||

| - Including Net Current Assets | : | 7.60% |

| *Computed on the invested amount for debt portfolio | ||

| ^Risk-free rate based on the FBIL Overnight MIBOR rate

of 6.4% as on Feb 28, 2025 For calculation methodology | ||

MULTIPLES FOR NEW INVESTMENT:

Rs. 5,000/- and in multiples of Re. 1/- thereafter.

ADDITIONAL INVESTMENT/MULTIPLES FOR EXISTING INVESTORS:

Rs. 1,000/- and in multiples of Re. 1/- thereafter.

LOAD STRUCTURE:| ENTRY LOAD | Not Applicable |

| EXIT LOAD |

Nil |

Please refer to our Tata Mutual Fund website for fundamental changes, wherever applicable

| Name of the Instrument | Ratings | Market Value Rs Lakhs | % to NAV |

| Debt Instruments | |||

| Government Securities | 92310.22 | 28.19 | |

| GOI - 6.79% (07/10/2034) | SOV | 23326.35 | 7.12 |

| GOI - 7.34% (22/04/2064) | SOV | 14901.11 | 4.55 |

| GOI - 7.10% (08/04/2034) | SOV | 9840.91 | 3.01 |

| GOI - 6.92% (18/11/2039) | SOV | 8513.79 | 2.60 |

| GOI - 7.18% (14/08/2033) | SOV | 6147.48 | 1.88 |

| GOI - 7.09% (05/08/2054) | SOV | 5133.90 | 1.57 |

| GOI - 7.18% (24/07/2037) | SOV | 4598.40 | 1.40 |

| Sgs Gujarat 7.64% (10/01/2031) | SOV | 3084.09 | 0.94 |

| Sgs Uttar Pradesh 7.51% (27/03/2038) | SOV | 2562.76 | 0.78 |

| SDL Maharashtra 7.10% (04/08/2036) | SOV | 2487.20 | 0.76 |

| Sgs Maharashtra 7.45% (20/03/2037) | SOV | 2042.17 | 0.62 |

| GOI - 7.23% (15/04/2039) | SOV | 1542.23 | 0.47 |

| Sgs Uttar Pradesh 7.41% (14/06/2034) | SOV | 1522.90 | 0.47 |

| Sgs Tamilnadu 7.35% (03/07/2034) | SOV | 1518.01 | 0.46 |

| Sgs Karnataka 7.68% (27/12/2037) | SOV | 1038.44 | 0.32 |

| Sgs Maharashtra 7.72% (23/03/2032) | SOV | 1032.47 | 0.32 |

| GOI - 7.30% (19/06/2053) | SOV | 661.66 | 0.20 |

| Sgs Uttar Pradesh 7.46% (22/03/2039) | SOV | 512.89 | 0.16 |

| Sgs Maharashtra 7.23% (04/09/2035) | SOV | 503.14 | 0.15 |

| SDL Rajasthan 8.29% (29/07/2025) | SOV | 281.77 | 0.09 |

| Sgs Maharashtra 7.73% (10/01/2036) | SOV | 265.51 | 0.08 |

| GOI - 6.68% (17/09/2031) | SOV | 199.40 | 0.06 |

| Sgs Maharashtra 7.63% (31/01/2036) | SOV | 197.07 | 0.06 |

| Sgs Karnataka 7.42% (06/03/2035) | SOV | 130.99 | 0.04 |

| SDL Karnataka 8.22% (09/12/2025) | SOV | 85.97 | 0.03 |

| GOI - 7.69% (17/06/2043) | SOV | 76.43 | 0.02 |

| Sgs Maharashtra 7.70% (08/11/2034) | SOV | 61.53 | 0.02 |

| SDL Tamilnadu 8.00% (28/10/2025) | SOV | 41.65 | 0.01 |

| Non-Convertible Debentures/Bonds | 206987.96 | 63.25 | |

| 07.70 % Rec Ltd. | CRISIL AAA | 13002.96 | 3.97 |

| 07.59 % National Housing Bank | CRISIL AAA | 12538.16 | 3.83 |

| 07.44 % Nabard | CRISIL AAA | 12483.41 | 3.81 |

| 07.68 % Small Indust Devlop Bank Of India | CRISIL AAA | 10027.02 | 3.06 |

| 07.83 % Indian Railways Finance Corporation Ltd. | CRISIL AAA | 7548.43 | 2.31 |

| 07.68 % Nabard | CRISIL AAA | 7541.31 | 2.30 |

| 07.75 % Small Indust Devlop Bank Of India | CRISIL AAA | 7531.74 | 2.30 |

| 07.40 % Nabard | CRISIL AAA | 7482.18 | 2.28 |

| 08.75 % Bharti Telecom Ltd. | CRISIL AA+ | 5073.10 | 1.55 |

| 08.90 % Muthoot Finance Ltd. | CRISIL AA+ | 5035.00 | 1.54 |

| 07.91 % Tata Capital Ltd. | CRISIL AAA | 5001.93 | 1.53 |

| 07.47 % Small Indust Devlop Bank Of India | CRISIL AAA | 4994.76 | 1.53 |

| 08.02 % Mindspace Business Parks Reit | CRISIL AAA | 5006.75 | 1.53 |

| 07.69 % Nexus Select Trust | CRISIL AAA | 4998.32 | 1.53 |

| 07.60 % Power Finance Corporation | CRISIL AAA | 5021.13 | 1.53 |

| 07.74 % LIC Housing Finance Ltd. | CRISIL AAA | 5008.28 | 1.53 |

| 08.10 % Godrej Industries Ltd. | CRISIL AA+ | 4995.11 | 1.53 |

| 09.10 % Cholamandalam Invt & Fin Co Ltd. | ICRA AA+ | 5000.82 | 1.53 |

| 07.56 % Rec Ltd. | CRISIL AAA | 5003.76 | 1.53 |

| 07.13 % Power Finance Corporation | CRISIL AAA | 4968.33 | 1.52 |

| 08.65 % Bharti Telecom Ltd. | CRISIL AA+ | 3518.04 | 1.07 |

| 07.85 % Interise Trust | ICRA AAA | 3362.75 | 1.03 |

| 08.90 % Bharti Telecom Ltd. | CRISIL AA+ | 3078.53 | 0.94 |

| 07.79 % Small Indust Devlop Bank Of India | CRISIL AAA | 2511.08 | 0.77 |

| 07.45 % Rec Ltd. | CRISIL AAA | 2505.47 | 0.77 |

| 09.25 % Shriram Finance Ltd. | CRISIL AA+ | 2509.26 | 0.77 |

| 08.45 % Nomura Capital (India) Pvt Ltd. | IND AAA | 2507.91 | 0.77 |

| 07.93 % LIC Housing Finance Ltd. | CRISIL AAA | 2508.03 | 0.77 |

| 07.98 % Bajaj Housing Finance Ltd. | CRISIL AAA | 2506.00 | 0.77 |

| 07.68 % LIC Housing Finance Ltd. | CRISIL AAA | 2518.97 | 0.77 |

| 08.00 % Tata Capital Housing Finance Ltd. | CRISIL AAA | 2515.17 | 0.77 |

| 07.69 % LIC Housing Finance Ltd. | CRISIL AAA | 2520.97 | 0.77 |

| 08.28 % Pnb Housing Finance Ltd. | CRISIL AA+ | 2506.67 | 0.77 |

| 08.54 % Cholamandalam Invt & Fin Co Ltd. | ICRA AA+ | 2520.52 | 0.77 |

| 08.95 % Bharti Telecom Ltd. | CRISIL AA+ | 2519.66 | 0.77 |

| 07.75 % Tata Capital Housing Finance Ltd. | CRISIL AAA | 2499.13 | 0.76 |

| 09.00 % Cholamandalam Invt & Fin Co Ltd. | ICRA AA+ | 2492.77 | 0.76 |

| 08.15 % Godrej Properties Ltd. | ICRA AA+ | 2499.74 | 0.76 |

| 07.97 % Kotak Mahindra Prime Ltd. | CRISIL AAA | 2501.35 | 0.76 |

| 07.85 % ICICI Home Finance Co.Ltd. | CRISIL AAA | 2500.72 | 0.76 |

| 07.34 % Small Indust Devlop Bank Of India | CRISIL AAA | 2486.20 | 0.76 |

| 08.00 % Ongc Petro-Additions Ltd. | ICRA AAA(CE) | 2499.96 | 0.76 |

| 05.94 % Rec Ltd. | CRISIL AAA | 2460.76 | 0.75 |

| 06.07 % Nabard | CRISIL AAA | 2409.11 | 0.74 |

| 07.95 % Mindspace Business Parks Reit | CRISIL AAA | 1503.22 | 0.46 |

| 07.72 % Bharat Sanchar Nigam Ltd. | CRISIL AAA(CE) | 1011.72 | 0.31 |

| 08.65 % Muthoot Finance Ltd. | CRISIL AA+ | 1002.65 | 0.31 |

| 09.10 % Power Finance Corporation | CRISIL AAA | 526.43 | 0.16 |

| 07.75 % Tmf Holdings Ltd. (TATA Group) | CRISIL AA+ | 497.47 | 0.15 |

| 07.55 % Rec Ltd. | CRISIL AAA | 502.93 | 0.15 |

| 06.40 % LIC Housing Finance Ltd. | CRISIL AAA | 489.34 | 0.15 |

| 08.55 % Indian Railways Finance Corporation Ltd. | CRISIL AAA | 311.47 | 0.10 |

| 07.97 % LIC Housing Finance Ltd. | CRISIL AAA | 121.45 | 0.04 |

| 06.75 % Sikka Ports And Terminals Ltd. (Mukesh Ambani Group) | CRISIL AAA | 98.90 | 0.03 |

| 06.92 % Indian Railways Finance Corporation Ltd. | CRISIL AAA | 97.91 | 0.03 |

| 08.35 % Indian Railways Finance Corporation Ltd. | CRISIL AAA | 103.20 | 0.03 |

| Securitised Debt Privately Placed/ Unlisted | 13527.35 | 4.13 | |

| 08.85 % Sansar June 2024 Trust | CRISIL AAA(SO) | 6562.50 | 2.00 |

| 08.20 % India Universal Trust Al1 | IND AAA(SO) | 4588.43 | 1.40 |

| 08.17 % India Universal Trust Al2 | CRISIL AAA(SO) | 2376.42 | 0.73 |

| Aif Cat Ii | 740.85 | 0.23 | |

| Sbimf Aif - Cat I (Cdmdf)27/10/2038 | 740.85 | 0.23 | |

| Repo | 9275.16 | 2.83 | |

| Portfolio Total | 322841.55 | 98.63 | |

| Cash / Net Current Asset | 4617.02 | 1.37 | |

| Net Assets | 327458.57 | 100.00 | |