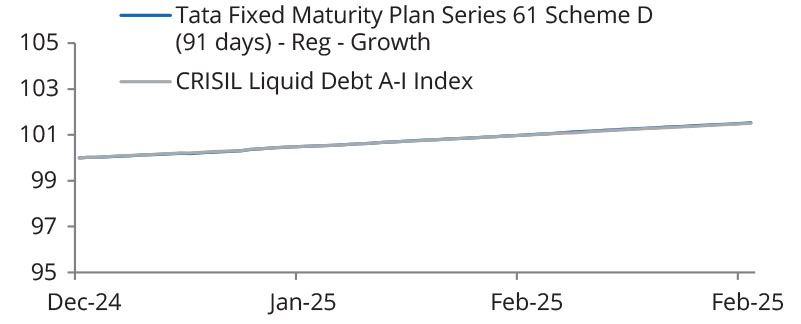

| Tata Fixed Maturity Plan Series 61 Scheme D (91 days)

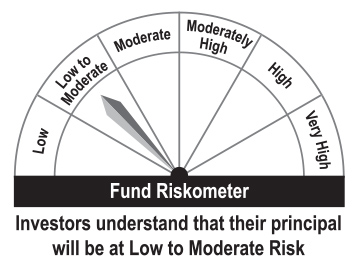

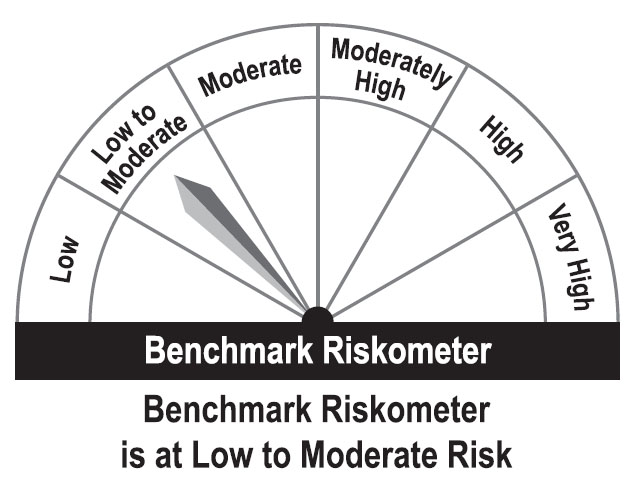

(A Close Ended Debt Scheme. Relatively Low interest |

|

As on 28th February 2025

|

A Close Ended Debt Scheme. Relatively Low interest rate risk and moderate Credit Risk.

INVESTMENT OBJECTIVE:The investment objective of the scheme is to generate income and / or capital appreciation by investing in Fixed Income Instruments having maturity in line with the maturity of the scheme. The maturity of all investments shall be equal to or less than the maturity of the scheme. However, there is no assurance or guarantee that the investment objective of the Scheme will be achieved. The scheme does not assure or guarantee any returns.

DATE OF ALLOTMENT:December 05, 2024

FUND MANAGER(S)Akhil Mittal (Managing Since 05-Dec-24 and overall experience of 23 years)

BENCHMARK:CRISIL Liquid Debt A-I Index

NAV (in Rs.)| Direct - Growth | : 10.1684 |

| Direct - IDCW | : 10.1684 |

| Reg - Growth | : 10.1660 |

| Reg - IDCW | : 10.1660 |

| FUND SIZE | |

| Rs. 212.22 (Rs. in Cr.) | |

| MONTHLY AVERAGE AUM | |

| Rs. 211.67 (Rs. in Cr.) | |

| EXPENSE RATIO** | |

| Direct | 0.05 |

| Regular | 0.15 |

| **Note: The rates specified are actual month end expenses charged as on Feb 28, 2025. The above ratio includes the GST on Investment Management Fees. The above ratio excludes, borrowing cost, wherever applicable. | |

For calculation methodology

| Portfolio Macaulay Duration | : | 0.14 Months |

| Modified Duration | : | 0.14 Months |

| Average Maturity | : | 0.14 Months |

| Annualized Yield to Maturity (For Debt Component)* | ||

| - Including Net Current Assets | : | 6.99% |

| *Computed on the invested amount for debt portfolio | ||

| YTM, Macaulay Duration and Modified Duration is post adjustment of IRS positions in the Fund. For details of IRS positions please refer to Monthly Portfolio. | ||

| ^Risk-free rate based on the FBIL Overnight MIBOR rate of 6.4% as

on Feb 28, 2025 | ||

MULTIPLES FOR NEW INVESTMENT:

Rs. 5,000/- and in multiples of Re. 1/- thereafter.

ADDITIONAL INVESTMENT/MULTIPLES FOR EXISTING INVESTORS:

NA

LOAD STRUCTURE:| ENTRY LOAD | Not Applicable |

| EXIT LOAD |

Nil |

Please refer to our Tata Mutual Fund website for fundamental changes, wherever applicable

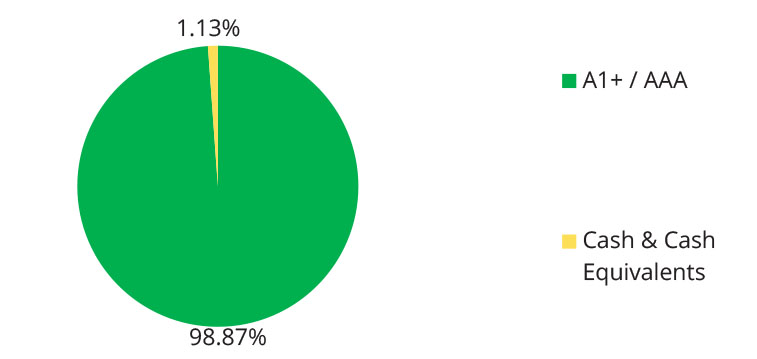

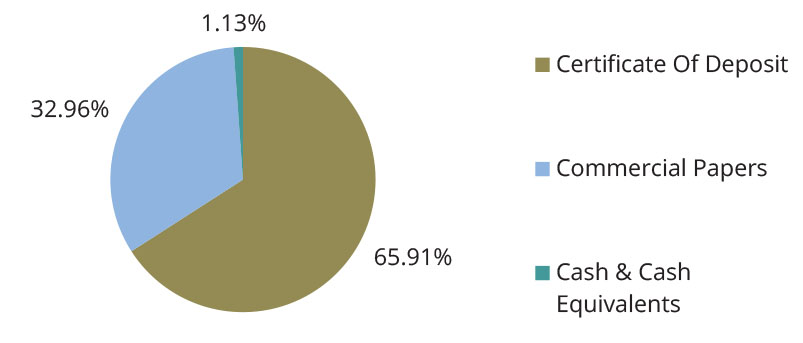

| Name of the Instrument | Ratings | Market Value Rs Lakhs | % to NAV |

| Debt Instruments | |||

| Money Market Instruments | 20982.98 | 98.89 | |

| HDFC Bank Ltd. - CD | CRISIL A1+ | 1998.11 | 9.42 |

| Kotak Mahindra Bank - CD | CRISIL A1+ | 1998.49 | 9.42 |

| Axis Bank Ltd. - CD | CRISIL A1+ | 1998.49 | 9.42 |

| Kotak Securities Ltd. - CP | CRISIL A1+ | 1998.79 | 9.42 |

| Bank Of Baroda - CD | IND A1+ | 1998.10 | 9.42 |

| Canara Bank - CD | CRISIL A1+ | 1998.12 | 9.42 |

| Union Bank Of India - CD | ICRA A1+ | 1998.49 | 9.42 |

| Indian Bank - CD | CRISIL A1+ | 1998.12 | 9.42 |

| ICICI Securities Ltd. - CP | CRISIL A1+ | 1997.98 | 9.41 |

| EXIM - CP | CRISIL A1+ | 1499.15 | 7.06 |

| LIC Housing Finance Ltd. - CP | CRISIL A1+ | 1499.14 | 7.06 |

| Repo | 235.61 | 1.11 | |

| Portfolio Total | 21218.59 | 100.00 | |

| Cash / Net Current Asset | 3.17 | 0.00 | |

| Net Assets | 21221.76 | 100.00 | |