| Tata Short Term Bond Fund

(An open ended short term debt scheme investing in instruments with Macaulay duration between 1 year and 3 years (Refer to page no. 15 of SID). A Relatively High Interest Rate Risk and Moderate Credit Risk.) |

|

As on 28th February 2025

|

A debt scheme that invests in short term debt instruments having high level of liquidity.

INVESTMENT OBJECTIVE:The investment objective is to generate regular income/appreciation over a short term period. There can be no assurance that the investment objective of the Scheme will be realised.

DATE OF ALLOTMENT:August 8, 2002

FUND MANAGER(S)Murthy Nagarajan (Managing Since 01-Apr-17 and overall experience of 28 years) & Abhishek Sonthalia (Managing Since 06-Feb-20 and overall experience of 16 years)

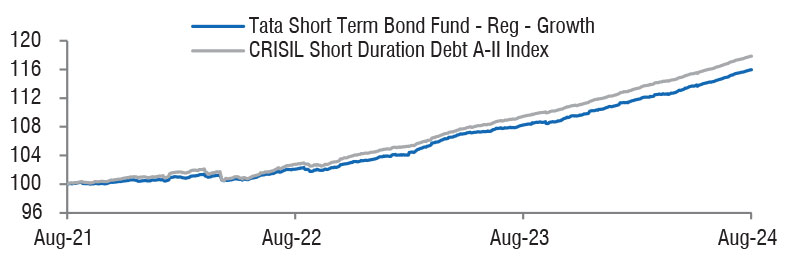

BENCHMARK:CRISIL Short Duration Debt A-II Index

NAV (in Rs.)| Direct - Growth | : 51.2097 |

| Direct - Monthly IDCW | : 23.2577 |

| Direct -IDCW | : 27.1722 |

| Reg - Growth | : 46.4143 |

| Reg - Monthly IDCW | : 20.9609 |

| Reg -IDCW | : 24.5923 |

| FUND SIZE | |

| Rs.2746.57 (Rs. in Cr.) | |

| MONTHLY AVERAGE AUM | |

| Rs.2734.13 (Rs. in Cr.) | |

| EXPENSE RATIO** | |

| Direct | 0.37 |

| Regular | 1.20 |

| **Note: The rates specified are actual month end expenses charged as on Feb 28, 2025. The above ratio includes the GST on Investment Management Fees. The above ratio excludes, borrowing cost, wherever applicable. | |

| VOLATILITY MEASURES^ | FUND | BENCHMARK |

| Std. Dev (Annualised) | 1.09 | 1.09 |

| Portfolio Beta | 0.89 | NA |

| R Squared | 0.84 | NA |

| Treynor | -0.06 | NA |

| Jenson | -0.04 | NA |

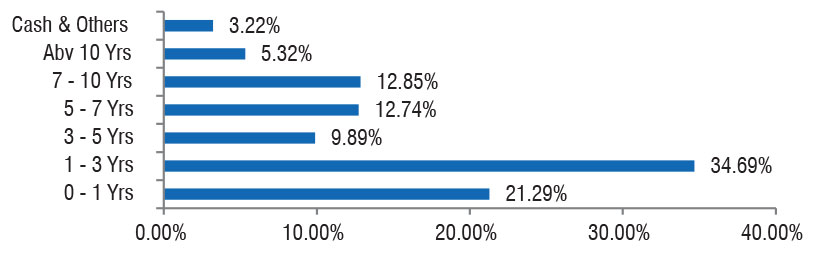

| Portfolio Macaulay Duration | : | 2.92 Years |

| Modified Duration | : | 2.79 Years |

| Average Maturity | : | 3.85 Years |

| Annualized Yield to Maturity (For Debt Component)* | ||

| - Including Net Current Assets | : | 7.43% |

| *Computed on the invested amount for debt portfolio | ||

| ^Risk-free rate based on the FBIL Overnight MIBOR rate

of 6.4% as on Feb 28, 2025 For calculation methodology | ||

MULTIPLES FOR NEW INVESTMENT:

Rs. 5,000/- and in multiples of Re. 1/- thereafter.

ADDITIONAL INVESTMENT/MULTIPLES FOR EXISTING INVESTORS:

Rs. 1,000/- and multiples of Re. 1/- thereafter.

LOAD STRUCTURE:| ENTRY LOAD | Not Applicable |

| EXIT LOAD |

Nil (w.e.f 24th January, 2019) |

Please refer to our Tata Mutual Fund website for fundamental changes, wherever applicable

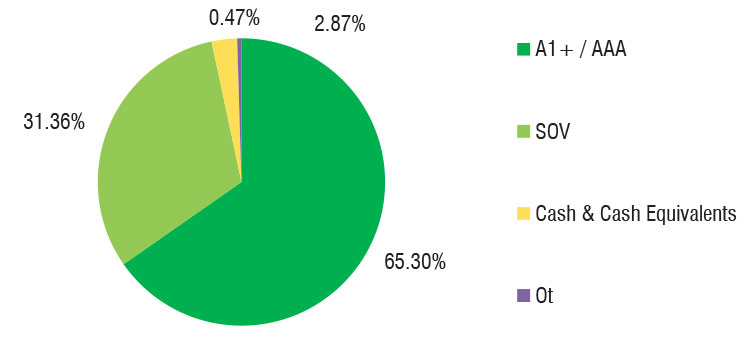

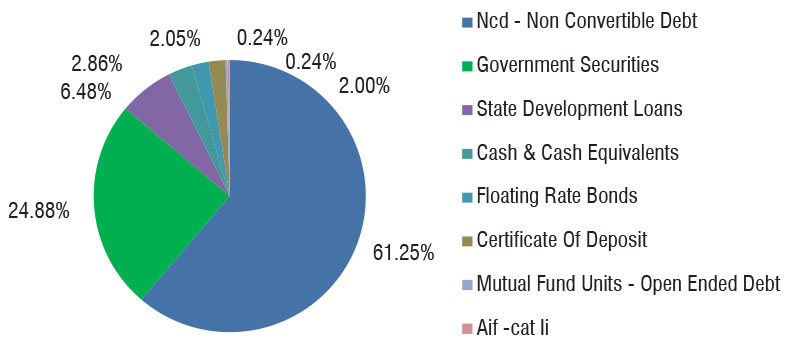

| Company name | Ratings | Market Value Rs Lakhs | % to NAV |

| Debt Instruments | |||

| Government Securities | 84246.80 | 30.71 | |

| GOI - 7.32% (13/11/2030) | SOV | 22647.22 | 8.25 |

| GOI - 6.79% (07/10/2034) | SOV | 16108.25 | 5.86 |

| GOI - 7.10% (08/04/2034) | SOV | 11850.93 | 4.31 |

| GOI - 6.92% (18/11/2039) | SOV | 8859.35 | 3.23 |

| GOI - 7.17% (17/04/2030) | SOV | 6635.97 | 2.42 |

| GOI - 7.02% (18/06/2031) | SOV | 3900.10 | 1.42 |

| GOI - 7.18% (14/08/2033) | SOV | 2817.60 | 1.03 |

| GOI - 7.09% (05/08/2054) | SOV | 2485.86 | 0.91 |

| GOI - 7.10% (18/04/2029) | SOV | 2033.37 | 0.74 |

| Sgs Gujarat 7.64% (10/01/2031) | SOV | 1428.55 | 0.52 |

| Sgs Maharashtra 7.49% (07/02/2036) | SOV | 1085.85 | 0.40 |

| GOI - 7.06% (10/04/2028) | SOV | 1013.06 | 0.37 |

| Sgs Tamilnadu 7.44% (05/06/2034) | SOV | 509.13 | 0.19 |

| Sgs Tamilnadu 7.44% (20/03/2034) | SOV | 509.03 | 0.19 |

| Sgs Maharashtra 7.63% (31/01/2036) | SOV | 516.96 | 0.19 |

| GOI - 7.27% (08/04/2026) | SOV | 483.89 | 0.18 |

| GOI - 7.38% (20/06/2027) | SOV | 381.07 | 0.14 |

| GOI - 7.26% (06/02/2033) | SOV | 263.31 | 0.10 |

| Sgs Tamilnadu 7.42% (03/04/2034) | SOV | 203.35 | 0.07 |

| GOI - 5.79% (11/05/2030) | SOV | 197.68 | 0.07 |

| Sgs Maharashtra 7.63% (31/01/2035) | SOV | 123.95 | 0.05 |

| Sgs Maharashtra 7.70% (08/11/2034) | SOV | 51.80 | 0.02 |

| GOI - 5.77% (03/08/2030) | SOV | 58.40 | 0.02 |

| GOI - 6.54% (17/01/2032) | SOV | 18.78 | 0.01 |

| GOI - 6.19% (16/09/2034) | SOV | 36.86 | 0.01 |

| GOI - 7.26% (14/01/2029) | SOV | 26.06 | 0.01 |

| SDL Tamilnadu 8.18% (19/12/2028) | SOV | 0.42 | 0.00 |

| Non-Convertible Debentures/Bonds | 136188.00 | 49.59 | |

| 07.57 % Nabard | CRISIL AAA | 7489.52 | 2.73 |

| 07.55 % Power Finance Corporation | CRISIL AAA | 7498.62 | 2.73 |

| 07.25 % Small Indust Devlop Bank Of India | CRISIL AAA | 7473.24 | 2.72 |

| 06.40 % Jamnagar Utilities & Power Pvt. Ltd. (Mukesh Ambani Group) | CRISIL AAA | 7351.31 | 2.68 |

| 07.45 % Exim | CRISIL AAA | 5022.70 | 1.83 |

| 08.45 % Nomura Capital (India) Pvt Ltd. | IND AAA | 5015.82 | 1.83 |

| 07.59 % National Housing Bank | CRISIL AAA | 5015.27 | 1.83 |

| 07.53 % Nabard | CRISIL AAA | 5005.91 | 1.82 |

| 07.64 % Power Finance Corporation | CRISIL AAA | 4999.22 | 1.82 |

| 07.58 % Nabard | CRISIL AAA | 4993.37 | 1.82 |

| 07.84 % LIC Housing Finance Ltd. | CRISIL AAA | 5006.96 | 1.82 |

| 07.44 % Nabard | CRISIL AAA | 4993.37 | 1.82 |

| 07.68 % Indian Railways Finance Corporation Ltd. | CRISIL AAA | 5007.55 | 1.82 |

| 07.61 % LIC Housing Finance Ltd. | CRISIL AAA | 4989.95 | 1.82 |

| 07.85 % Interise Trust | ICRA AAA | 4803.94 | 1.75 |

| 07.40 % Sundaram Fin Ltd. | CRISIL AAA | 4487.27 | 1.63 |

| 07.43 % Small Indust Devlop Bank Of India | CRISIL AAA | 3986.31 | 1.45 |

| 08.10 % Bajaj Housing Finance Ltd. | CRISIL AAA | 2519.15 | 0.92 |

| 07.57 % LIC Housing Finance Ltd. | CRISIL AAA | 2488.93 | 0.91 |

| 07.97 % Kotak Mahindra Investments Ltd. | CRISIL AAA | 2499.30 | 0.91 |

| 07.73 % Tata Capital Housing Finance Ltd. | CRISIL AAA | 2505.14 | 0.91 |

| 08.10 % Bajaj Finance Ltd. | CRISIL AAA | 2504.59 | 0.91 |

| 07.44 % Small Indust Devlop Bank Of India | CRISIL AAA | 2495.89 | 0.91 |

| 07.80 % Rec Ltd. | CRISIL AAA | 2504.42 | 0.91 |

| 07.54 % Small Indust Devlop Bank Of India | CRISIL AAA | 2494.60 | 0.91 |

| 07.15 % Small Indust Devlop Bank Of India | CRISIL AAA | 2490.61 | 0.91 |

| 07.91 % Tata Capital Ltd. | CRISIL AAA | 2500.96 | 0.91 |

| 07.71 % Rec Ltd. | CRISIL AAA | 2509.63 | 0.91 |

| 07.59 % Power Finance Corporation | CRISIL AAA | 2509.12 | 0.91 |

| 07.74 % LIC Housing Finance Ltd. | CRISIL AAA | 2504.14 | 0.91 |

| 07.47 % Small Indust Devlop Bank Of India | CRISIL AAA | 2492.96 | 0.91 |

| 07.40 % Nabard | CRISIL AAA | 2494.06 | 0.91 |

| 07.55 % Rec Ltd. | CRISIL AAA | 2506.49 | 0.91 |

| 07.44 % Power Finance Corporation | CRISIL AAA | 1997.50 | 0.73 |

| 06.30 % Hdb Financial Services Ltd. (HDFC Ltd.) | CRISIL AAA | 499.66 | 0.18 |

| 07.54 % Rec Ltd. | CRISIL AAA | 499.57 | 0.18 |

| 08.27 % National Highways Authority Of India | CRISIL AAA | 30.95 | 0.01 |

| Securitised Debt Privately Placed/ Unlisted | 16235.98 | 5.92 | |

| 08.85 % Sansar June 2024 Trust | CRISIL AAA(SO) | 6562.50 | 2.39 |

| 08.02 % India Universal Trust Al1 | IND AAA(SO) | 4683.49 | 1.71 |

| 08.09 % India Universal Trust Al2 | CRISIL AAA(SO) | 3105.76 | 1.13 |

| 08.12 % India Universal Trust Al1 | IND AAA(SO) | 1884.23 | 0.69 |

| Money Market Instruments | 18851.26 | 6.87 | |

| HDFC Bank Ltd. - CD | CRISIL A1+ | 4797.36 | 1.75 |

| Axis Bank Ltd. - CD | CRISIL A1+ | 4694.01 | 1.71 |

| Axis Bank Ltd. - CD | CRISIL A1+ | 4693.09 | 1.71 |

| HDFC Bank Ltd. - CD | CRISIL A1+ | 4666.80 | 1.70 |

| Name of the Instrument | Market Value Rs. Lakhs | % to NAV | |

| Mutual Fund Units Related | |||

| Mutual Fund Units | 598.79 | 0.22 | |

| Tata Nifty SDL Plus Aaa Psu Bond Dec 2027 60 40 Index Fund | 598.79 | 0.22 | |

| Aif Cat Ii | 738.15 | 0.27 | |

| Sbimf Aif - Cat I (Cdmdf)27/10/2038 | 738.15 | 0.27 | |

| Repo | 11054.68 | 4.02 | |

| Portfolio Total | 267913.66 | 97.60 | |

| Cash / Net Current Asset | 6742.95 | 2.40 | |

| Net Assets | 274656.61 | 100.00 | |

| Note Sundry Debtors: 1) Rs 170 crs. due against redemption of Commercial Paper of Infrastructure Leasing & Financial Services Ltd matured respectively on 26/09/2018 , 27/11/2018 . 2) Rs 25 crs. due against redemption of NCD's of IL & FS FINANCIAL SERVICES LTD matured on 08/11/2019 , the same are not included in the above portfolio statement. | |||